Looking for an Agency Acquisition – Register with OIA’s Agency Link

Agency acquisitions continue at a blistering pace despite the COVID pandemic, the administration change, and many other economic uncertainties. While there was a lull in agency M&A activity during April and May of 2020, it quickly rebounded and 2020 was on course to finish in close to record fashion.

The M&A activity is being driven by several factors including low-interest rates, a flood of Private Equity (PE) backed buyers, agencies steady performance and valuations, current favorable tax policies, and an aging ownership base in the IA system.

On that note, according to OIA’s internal data, $2.5 Billion of Ohio’s $17 Billion P&C markets is controlled by agencies that have a principal with an average age of 61. That means 15% of Ohio’s P&C market is likely to change hands in the next 3-5 years. These mature agencies are typically profitable, well managed, have a favorable loss ratio, high retention rates, stagnant to minimal YOY growth, and a portfolio of solid carrier relationships. Many of these factors make these agencies very attractive from a merger or acquisition standpoint.

On that note, according to OIA’s internal data, $2.5 Billion of Ohio’s $17 Billion P&C markets is controlled by agencies that have a principal with an average age of 61. That means 15% of Ohio’s P&C market is likely to change hands in the next 3-5 years. These mature agencies are typically profitable, well managed, have a favorable loss ratio, high retention rates, stagnant to minimal YOY growth, and a portfolio of solid carrier relationships. Many of these factors make these agencies very attractive from a merger or acquisition standpoint.

These agencies are being acquired and transitioning in several ways, including internal perpetuation to the next generation, purchased by PE-backed buyers or publicly traded broker, and merging or acquisition by another retail agency.

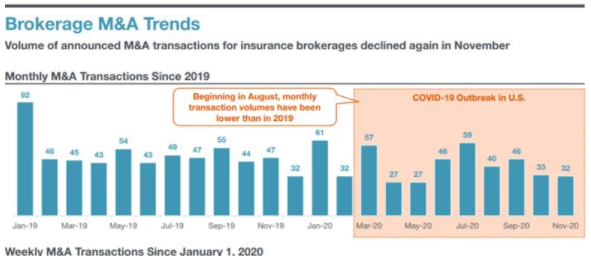

The folklore in the IA system is that PE-backed buyers are the primary acquirers and have the inside track because of their resources, scale, and infrastructure. Most publicly reported information like the M&A Brokerage trends graph from Piper Sandler tends to only reflect deals where there was a press release included in the transaction and this includes 65% of PE-backed deals. However, that does not mean retail agencies should feel frozen out of the buying marketplace.

In fact, OIA’s internal data shows 91% of the agency transitions in the past 3 years were internal perpetuations or privately held/retail agency mergers or acquisitions. We fully expect PE buyers to remain the most active in the marketplace for publicly announced deals, however, we also anticipate that hundreds of transitions will happen and never be reported in the industry trade publications. Retail agency owners should seek out prospective sellers that are a match with their cultural values, treatment of the owner and team post-transaction, and legacy of the agency in the community.

In 2021 and beyond, we expect agency M&A rates to hold steady and possibly increase. While every record–breaking M&A year thins the ranks of M&A targets, new agencies are starting, young agencies are growing and becoming attractive acquisition targets for all prospective buyers.

If growth by acquisition is part of your expansion strategy, we strongly encourage you to leverage your OIA membership and register for Agency Link to get access to agencies that are looking to merge, sell or transition to the next generation.

OIA has helped many agencies transition to the next generation, merge, and sell to other agencies. Whether it is determining the fair market value of your agency, creating a perpetuation plan for the next generation, or finding prospective buyers for your agency, we are here to serve you.

For more information on Agency Link click here or contact Jeff Smith at jeff@ohioinsuranceagents.com.