It is hard to say, however, based on our analysis, we believe the optimal age is 58.

Whether you are planning to perpetuate internally or sell externally, it is inevitable that you are going to sell your ownership at some point. In this article we explore whether there is an optimal age to transition ownership of your agency.

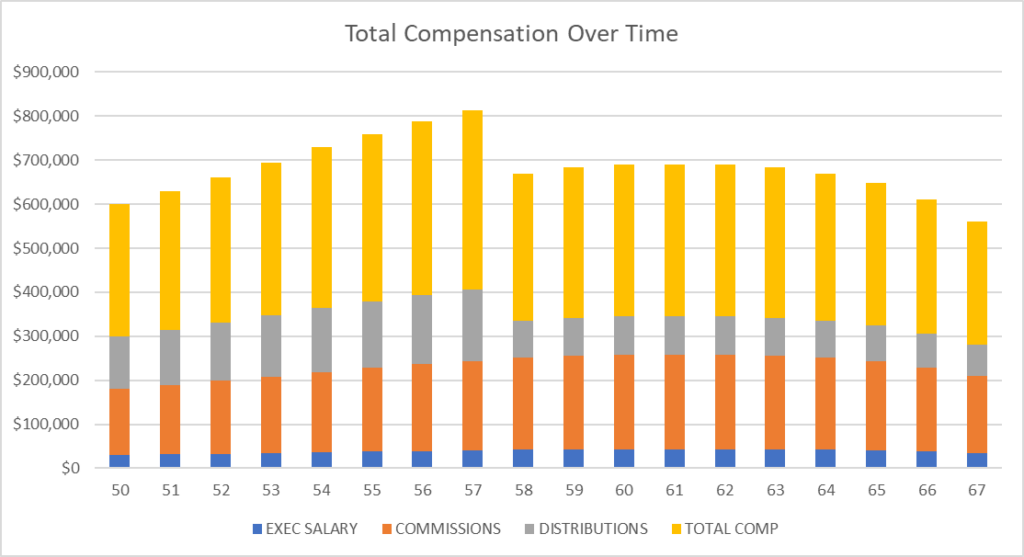

Every situation is unique, so consider that as you read this article. Our analysis is based on the average $600k annual revenue agency that we often analyze for our valuations. We reviewed the financial projections of what happens to the growth, profitability, and value of an agency as an agency owner ages, in determining that 58 is the optimal age to sell an insurance agency.

How did we reach this number? In sum, our analysis shows that selling at this age allows you to maximize the entire financial package of owning an insurance agency.

- Benefits of Ownership – It gives you enough time to enjoy the benefits of owner distributions. At the age of 58, you will likely have had 12-15 years of owning the agency and thereby reaping the rewards of distributions.

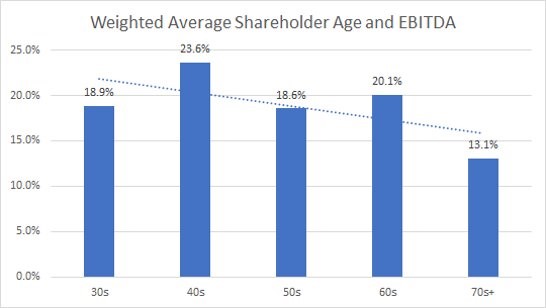

- Peak Value of the Agency – Agencies with owners in their 50s tend to still be growing and therefore agency value is still increasing. Once agency owners enter their 60s and 70s, we traditionally see growth and profitability decline, which causes a decrease in agency value.

- Energy to Achieve the Earnout – Most sales come with the incentive of a 3-year growth earnout that can be worth as much as 25% to 33% of the entire transaction. By selling at 58 instead of 65, you will likely have more energy and focus to put in the work to hit your earnout and therefore maximize your return.

- Quality of Life and Continued Earnings – By selling at this age, you are likely still healthy, so you can continue to work with less stress and focus more on enjoying your life. Your work allows you to help transition the agency, stay engaged professionally, continue to earn money, and fulfill a lifetime passion of serving clients.

This is a short summary of our conclusions; below, we will go into greater analysis as to why we believe 58 is generally the right age for an owner to sell their ownership.

Benefits of Ownership

This is the most variable factor in the equation. Owners love the distributions associated with ownership. It is the culmination of their hard work bearing fruit.

Distributions largely depend on the growth and profitability of the agency. Our analysis shows that the profitability of the agency declines significantly when an owner is in their 70s. As to how long the agency owner should/could hold onto ownership while maximizing distributions, continuing to invest in the agency, and preserving peak value, it’s a question of risk and reward.

In a sale, the buyer is advancing the seller the future forecasted profits of the agency for a lump sum of money and thereby transferring risk and reward from the current owner. If the owner feels confident that they can continue to make the necessary investments to grow while remaining profitable, then holding for an additional year, two, or three of distributions likely makes good business sense.

While an owner can continue to enjoy profitability in their 50s and 60s, we believe the age of 58 allows the owner to have received significant distributions of ownership over a 12-to-15 year period of time. The tradeoff for the benefit of ownership is the additional stress that comes with ownership and the risk of continuing those profits.

Peak Value of the Agency

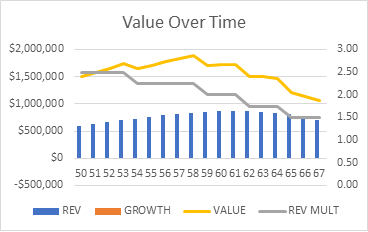

All buyers want to purchase an appreciating asset, not a declining one. Our analysis shows that the value of most agencies peaks when the owners are in their 50s and then begins to decline when the owners are in their 60s and 70s. Why is this? In large part, because the growth and profitability of the agency begin to decline as the owners’ age advances into their 60s and 70s.

So, this raises the question: can you hang on to ownership for too long? The analysis for you will depend upon your agency’s current and future performance and your own personal financial situation and goals. All these things considered, we believe an owner CAN overstay their welcome.

In our analysis, we steadily see the value of the agency growing along with the revenue until the agency owner reaches 58 years old. At that point, the agency begins to slow down, as does the growth and value. At 58, the agency is still growing and appreciating in value. After that age, the growth becomes stagnant and declines, therefore the value of the asset begins to decline.

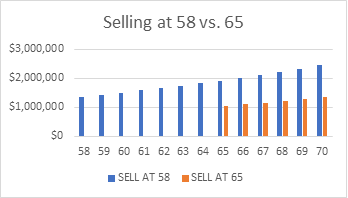

We reviewed the hypothetical sale of an agency at 58 vs. 65 and found that if an agency owner sells at 58 and invests the purchase price money at a 5% return, they wind up at almost double the money at 70 than an owner who sells at 65.

Energy to Achieve the Earnout

Many agency sales are structured in a manner to provide for the seller to have an earnout over a three-year period of time if they meet certain organic growth measures. These opportunities can be worth as much as 25% to 33% of the overall deal value.

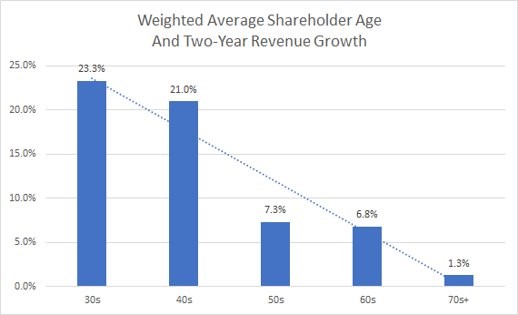

As you see in the graph, agency growth slows down significantly as owners enter their 50s, 60s, and 70s. Typically, hunger and need for growth dissipate as we age and the business transitions to more of a lifestyle operation. The interest and focus of the agency owner changes from an operation with a sales culture focused on growth to an agency with a service culture focused on protecting and retaining the current book of business. At this stage, many agency owners slow down their hunting efforts in order to build higher fences around the current clients.

Therefore, at 58, we believe there is a greater likelihood that you may still have the energy to grind and help the agency grow and achieve the additional earnout. The earnout can require anywhere from an annual 5% to 10% growth rate and compounded growth rate of 30% over three years. In this rate environment that may be attainable, but pre-2021, that type of growth was reserved for best practices agencies.

If you are trying to achieve a best practice level earnout at 65 or 68, it is going to be increasingly difficult to produce the type of organic growth needed to maximize your earnout opportunity.

Continued Earnings and Quality of Life

At 58, the owner still has an extended period with which they can work and produce business. They can do this at a better pace and with less stress of trying to manage day-to-day operations, employees, and the stress of growing a business. They can focus on the activities which typically provide them the greatest joy: taking care of their clients, solving complex risk problems, and engaging in their local community.

In today’s tight labor market, experienced insurance professionals are a coveted resource for insurance agencies. Most buyers put a premium on the retention of the owner and staff for an extended period of time. While the owner’s overall annual income will likely drop immediately after the sale, a well-negotiated deal will ensure the owner is compensated at a level commensurate with their experience and value to the agency.

Finally, we look at quality of life. The average life expectancy for an American is 76 years old. By selling the majority of your ownership at 58, it gives you close to 20 years to enjoy the fruits of your labor. At 58, we are mostly still healthy, mobile, and enjoy a high quality of life. Depending on your family situation, at this age your children are likely beginning to have their own children. Less stress and responsibility at the office frees you up to enjoy the second cycle of life’s greatest joys: grandchildren.

In addition, it gives you plenty of time with good health and mobility to travel and see the world . All of those items on your bucket list can become a reality. Your dream of sunshine in the winter becomes more real if you have transitioned the responsibility and stress of managing a business.

Conclusion

This is purely a financial and quality of life analysis based on what we have experienced happening in independent insurance agencies as the owner ages. Your situation is likely different than this, but the purpose of this article and analysis is to get you thinking about your own personal situation and begin planning for the inevitable.

Whether you are 48, 58, or 68, planning for the transition of your agency takes time and needs to be given the same diligence you have given building your business.

If you are trying to decide when the right time to transition your ownership, we’d encourage you to connect with IA Valuations’ CEO, Jeff Smith, JD, CIC, CAE at jeff@iavaluations.com to do an analysis of your agency’s value and maximum financial return.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.