The data doesn’t lie. The data is not subjective and does not discriminate. The fact is, agency ownership age negatively affects agency valuation.

Based on the various data sources that we will share in this article, all indications point to the conclusion that as the agency ownership gets older, the valuation multiplier is much lower thereby significantly reducing the agency valuation.

There are many factors as to why this happens, of which it would take more data and analysis to thoughtfully draw conclusions. For that reason, we will not opine on the cause of why agency owner(s) advanced age equals a reduction in agency valuation and will focus on the correlation of the data conclusions.

Valuations

Over the past 3 years, we have completed over 120 valuations on independent insurance agencies and our data shows that the older an agency ownership is, the lower their agency valuation.

First, let’s explain valuations and our method. Valuations are based on past results and future projected earnings and performance. The past results are indisputable because they are factual, data driven numbers that tell the financial story about the agency’s performance.

The projected future earnings and performance are somewhat subjective because it takes into account an agency’s business plan for growth and investments in the future. The projections have to track somewhat close to past performance in order to be a realistic prediction of accomplishing the agencies goals. For example, if the agency has experienced flat growth over the past 3 years and has a goal to grow by 25% per year in future years that is likely unrealistic unless they have a plan matched with investments that show grow of that aspirational nature is possible.

For our valuation method to determine the fair market value of your agency, we employ a multiple of Pro Forma EBITDA Valuation Method. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, & Amortization.

We make adjustments to remove non-recurring items, extraordinary items, and to adjust various expenses to industry norms. The resulting pro forma income statement reveals what the true profitability of the agency could be.

The EBITDA valuation method reflects a true calculation of value. The industry folklore is to use an expression of value by calculating agency valuation based on a multiple of revenue. While every valuation may be correlated to a multiple of revenue, basing a valuation on just that methodology is the equivalent of using the back of a cocktail napkin to value your life’s work. It is an ineffective and insufficient manner of calculating value.

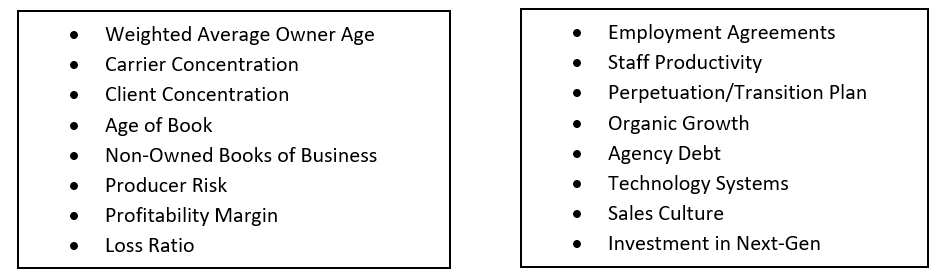

The Multiple ranges used in the EBITDA valuation reflect the overall risk of the agency and the current market. There are many items that are considered when determining the risk profile of the agency, include:

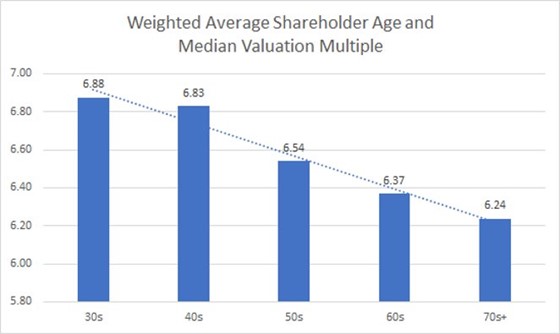

As you can see in the graph below, the EBITDA valuation multiplier peaks at 6.88 for agencies with ownership in their 30s and declines slightly for agency owners in their 40s at 6.83. It begins to take a significant decline for agencies with agency owner(s) in their 50s, 60s and 70s. For the average size agency, these declines in EBITDA multiplier is the equivalent of over $100,000 in agency value.

While the difference in EBITDA multiplier of 6.88 vs. 6.24 does not sound that great, it is significant. For a $1 Million annual revenue with a $300,000 profitability margin, the difference in the calculation of value is $192,000. That’s real money by all measures and may be the difference in two years early retirement, the vacation home down south or the RV for travelling the country.

Conclusion

It is not our intention with this series to drive older agency owners into early retirement, rather our goal is to encourage better planning to maximum agency value for your life’s work. Every agency owner will have to transition ownership of their agency at some point in their life, despite our best effort to drink from the fountain of youth, aging is inevitable.

In Ohio, our data shows $2.75 Billion of the $11.4 Billion of premium written by independent agents are controlled by 55+ year old owners, with an average age of 63. That means 24% of the premiums written in Ohio are controlled by agency owners withing 5 – 10 years of the traditional retirement age. While not all of this premium will change hands in the next few years, much of it will.

The bottom line, the better preparation and planning equals higher agency value. Here are some tips for how you can get started today:

- Complete a fair market valuation of your agency – to understand where you are going you must know where you are and where you have been. A valuation will help you understand your agency’s value, identify the risk factors in your agency, and develop a plan around each one to improve upon it. We encourage agencies to make an agency valuation part of their annual business planning processes to ensure that you always have a good barometer on the value of your agency and are working on addressing the risk factors.

- Develop a formal perpetuation/transition plan – every situation must have an exit strategy, particularly something as valuable as your agency. Whatever wishes you have for your agency – internal perpetuation or external sale – you must have a plan with your exit strategy. The more planning you do in advance the smoother the process and will likely lead to capturing a higher agency value.

- Establish a contingency buy-sell agreement – this is critical for every agency but particularly for those with single owners. The contingency buy-sell is insurance for your family, employees, and clients that if the unexpected happens to you, a structure is in place to preserve the agency and its value.

- Recruit and mentor young producers and agency staff with the potential of becoming owners – recruitment of younger producers and prospective future owners is key to maximizing your agency’s value. Even if you decide to sell externally, having successful younger producers will enhance the value of your agency.

Next week we will cover the impact of the agency owner(s) age on the EBITDA profitability of the agency. Please contact Jodie Shaw today to discuss your plans and how we can assist you in growing your agency value, solidifying your legacy and fulfilling your transition plans successfully.