Put quite simply, yes it does. Based on the various data sources that we will share in this article, all indications point to the conclusion that as the agency ownership gets older, organic growth slows down.

There are many factors as to why this happens, of which it would take more data and analysis to thoughtfully draw conclusions. For that reason, we will not opine on the cause of why agency owner(s) advanced age equals a reduction in agency growth and will focus on the correlation of the data conclusions.

Valuations

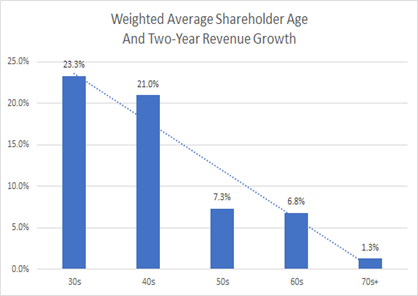

Over the past 3 years, we have completed over 120 valuations on independent insurance agencies and our data shows that the older an agency ownership is, the lower their agency growth.

As you can see in the graph below, the two-year growth rates for agencies with agency owner(s) in their 50s, 60s, and 70s are three times (3X) lower than agencies with owners in their 30s and 40s. While the average of all agencies in this chart is showing growth, the fastest growth rates of 20%+ each year are with younger agency owners. The drop-off is particularly pronounced with the 70+ agency owners.

OIA RISE Benchmarking Report

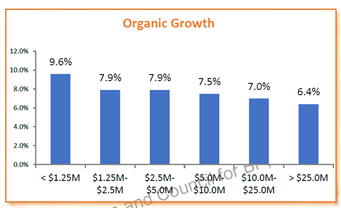

Our RISE benchmarking report shows similar results where younger agency owners, albeit not as wide of an age gap as the valuations, show that the younger agency owners grow at faster and steadier growth rates.

- Steady Organic Premium Growth: Steadily increasing positive annual growth in premium volume over the last five years (Compound Annual Growth Rate between 0-10%) without a book of business acquisition in the last three years.

- Fastest Organic Premium Growth: Accelerated average positive annual growth in premium volume over the last five years (Compound Annual Growth Rate greater than 10%, Prior Year Growth Rate greater than 0%, and Prior Year Minus One Growth Rate greater than 0%) without the help of business acquisitions in the last three years.

- Flat-Declining Growth: Negative or no change in premium volume over the last five years (Compound Annual Growth Rate less than or equal to 0%), regardless of business acquisitions.

Big I National and Reagan Consulting Best Practices Study

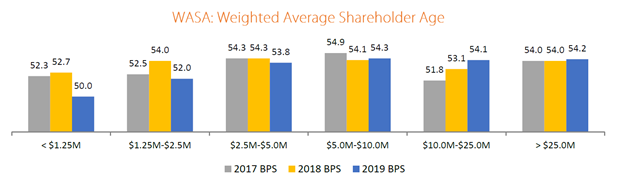

Finally, as we looked at the Big I National and Reagan Consulting 2019 Best Practices Study, we found similar results in the correlation between organic growth rates being highest among smaller agencies that happen to have younger agency ownership. For example, agencies with revenue below $1.25 Million grew organically at 9.6% and had an average owner age of 50, whereas the lower growth categories with the larger agencies all had agency owners that averaged over 54 years old.

Conclusion

It is not our intention with this series to drive older agency owners into early retirement, rather our goal is to encourage better planning to maximum agency value for your life’s work. Every agency owner will have to transition ownership of their agency at some point in their life, despite our best effort to drink from the fountain of youth, aging is inevitable.

In Ohio, our data shows $2.75 Billion of the $11.4 Billion of premium written by independent agents are controlled by 55+-year-old owners, with an average age of 63. That means 24% of the premiums written in Ohio are controlled by agency owners within 5 – 10 years of the traditional retirement age. While not all of this premium will change hands in the next few years, much of it will.

The bottom line, the better preparation, and planning equal higher agency value. Here are some tips for how you can get started today:

- Complete a fair market valuation of your agency – to understand where you are going you must know where you are and where you have been. A valuation will help you understand your agency’s value, identify the risk factors in your agency, and develop a plan around each one to improve upon it. We encourage agencies to make an agency valuation part of their annual business planning processes to ensure that you always have a good barometer on the value of your agency and are working on addressing the risk factors.

- Develop a formal perpetuation/transition plan – every situation must have an exit strategy, particularly something as valuable as your agency. Whatever wishes you have for your agency – internal perpetuation or external sale – you must have a plan with your exit strategy. The more planning you do in advance the smoother the process and will likely lead to capturing a higher agency value.

- Establish a contingency buy-sell agreement – this is critical for every agency but particularly for those with single owners. The contingency buy-sell is insurance for your family, employees, and clients that if the unexpected happens to you, a structure is in place to preserve the agency and its value.

- Recruit and mentor young producers and agency staff with the potential of becoming owners – recruitment of younger producers and prospective future owners is key to maximizing your agency’s value. Even if you decide to sell externally, having successful younger producers will enhance the value of your agency.

Keep in mind, Independent insurance agencies are trading at their highest multiple ever. That being said, there is a correlating loss in value as an agency’s owner(s) age. The data we are going to share on this point makes planning even more important. Craig Niess, the Business Valuation Manager for OIA, will lead your valuation and can guide you with the planning of your agency and improving your valuation. When you’re ready to know where your agency stands, contact Jodie Shaw to discuss your plans and how we can assist you in growing your agency value, solidifying your legacy, and fulfilling your transition plans successfully.