Leading up to the election there was a lot of speculation about what may happen to the value of your agency under a new Democratic regime? Potentially at risk was the past decade of unprecedented increases in agency valuations and favorable tax laws to transact agency sales.

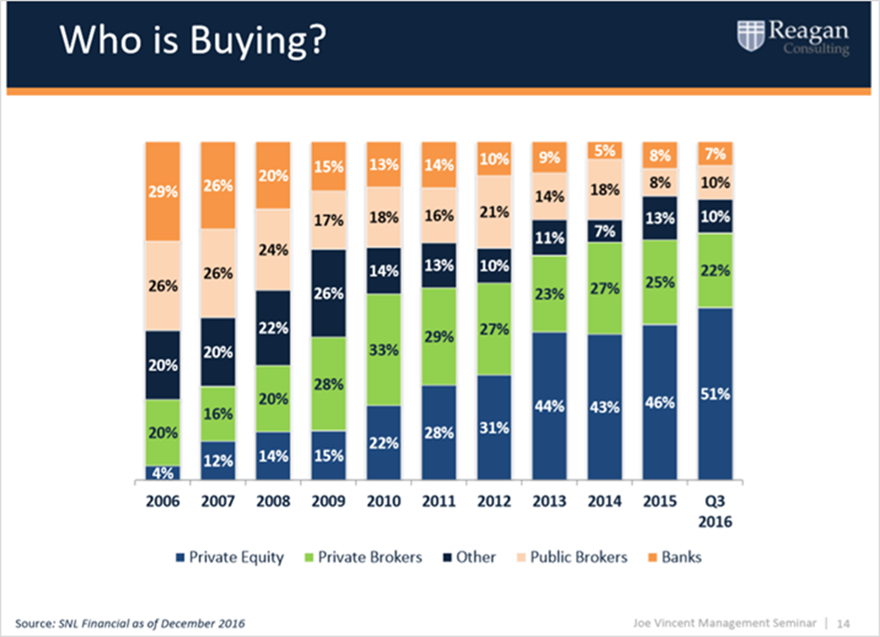

Before we speak to the impact of the outcome of the election, let’s take a walk down memory lane and reminisce about how agency valuations have become so inflated. In 2010, massive amounts of Private Equity (PE) money began being injected into the independent agency system, bringing a new set of buyers and steep inflation in agency valuations.

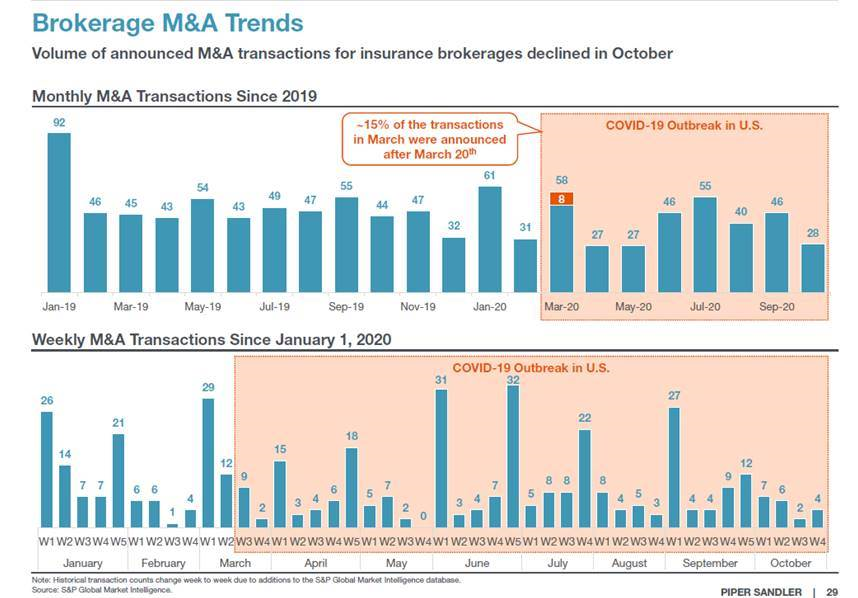

It appeared as if the COVID-19 pandemic was going to potentially slow or bring the PE buying to a halt but as this graph from Piper Sandler shows, that has not been the case.

After a two-month lull at the beginning of the pandemic, agency valuations and sales have held steady and there was much speculation that Q4 2020 and Q1 2021 based on the potential impact of the election. Prior to election day, most pollsters were showing a “blue wave” and sweep across all elected chambers of the federal government.

As a result, many in the independent agency system were readying for significant changes in the first part of 2021 due to the change in control of the Presidency and US Senate. The primary concerns were with corporate tax rates and whether Trump’s Tax Cuts and Jobs Act tax cuts would be repealed.

We are now a week removed from the election and we know a little more about the outcome of the election and potential impacts from it.

First, the White House appears to have gone to Joe Biden. While there are still expected legal challenges, recounts and no concession speech from President Trump, most pundits do not expect these to change the outcome of the election. It appears that Biden’s lead in several of the battleground states is too significant to overcome without some proof of overt fraud or illegal vote tampering. As we have come to realize with 2020, anything is possible but it seems unlikely that a movement of that significance could happen given the bi-partisan controls and checks and balances over elections at the local and state level.

Second, the US House of Representatives remained Democratic. While the Democrats unexpected suffered losses on election night, they have maintained their majority in the chamber and it appears as if the same leadership will be returning for the 2021 session. This means that the Democratic controlled House and White House will be aligned on their policy agenda.

Last but certainly not least, control of the U.S. Senate is still undetermined. In regard to impact on agency valuations from the election, a lot will depend on what happens in the Georgia Senate run-offs in January of 2021, where control of the U.S. Senate will be decided. Speculation over agency valuations due to significant federal policy changes will probably be least impacted by divided government.

With two Senate races in Georgia looming, and the fact that Georgia turned blue in this election for the first time in a generation, there is increased likelihood that Georgia could give Biden a ruling majority and enable him to pass more progressive legislation. This agenda would likely be in lockstep with the House and include a repeal of the Trump tax cuts. An increase in corporate taxes to fund his priorities along with an increase in the capital gains taxes and these changes could have an immediate impact on the value of your agency and factor into you making a decision on maximizing the value of your agency.

This week we experienced a brief surge in the stock market after Joe Biden was declared the winner on November 7th and a bullish outlook on the economy. In addition, we also experienced some good news on the progress with Pfizer’s vaccination trials.

While all of the aforementioned news this week is positive, it is incredibly premature to make business decisions and life altering decisions like contemplating the sale of your agency at a faster pace than you may be comfortable. We encourage agency owners to take a deep breath at this time, make a plan, consult with a professional like the OIA, be aware of what is happening in the policy and political arena and what may impact your agency’s value but do not make any knee jerk reactions.

You’ve likely spent decades of sweat equity building the value of your agency, the outcome of the 2020 election, COVID-19 and the stock market should not force you to sell prematurely. All of this election uncertainty and anxiety will be over by January when we know the outcome of the Georgia Senate runoff elections. In the meantime, keep selling new policies and retaining your current clients. Those efforts will do more to improve the value of your agency than tax or other policy changes.

If you have any questions or concerns, please reach out to Jeff Smith at jeff@ohioinsuranceagents.com or Craig Niess at craig@ohioinsuranceagents.com.