As we have shared throughout this valuation series, our data shows that as the agency ownership ages the agency’s growth, profitability, and valuation decreases. The net financial effect for a $1M revenue agency is approximately $192,000 in agency value lost by having an agency ownership average age predominately in the 60s and 70s.

While aging is inevitable, the fate of decline for an aging independent agency is not. Similar to our body’s health, we decide how we age. We decide whether we become sedentary and isolated or keep our minds and bodies active. We decide whether we cling to the “glory days” of the past or embrace change with a positive attitude.

It is our decision whether we transition to a lifestyle agency or a growth agency. It is our choice whether we retire in place or transition our clients and legacy to the next generation.

For our health and our agencies, many of the effects of aging can be overcome with diligent planning, commitment, and execution.

We are concluding this series with an agency success story. But first the disclaimer, “the characters and events depicted in this agency success story are fictitious. Any similarity to actual persons or agencies is purely coincidental.”

This is a story of an agency that chose growth instead of decline. They chose preservation of legacy instead of a fire sale. They chose a smooth transition of clients, staff, and carriers instead of a sale to the highest bidder and future unknown for all those involved. So what did they do:

They developed a transition plan 5 – 7 years in advance of the retirement of the aging owners. They made investments in the next generation. They made commitments and worked the plan. They executed their plan and are now enjoying an agency that grows by double digits each year and has a healthy group of next-generation agency owners to buy out the retiring majority owners. They did the hard work and are now positioned to enjoy the fruits of their labor.

Case Study

First, let’s share some context on the “Well-Planned Agency.” The agency had three principals that each owned an equal share of the agency stock and were all in their late 50s when they decided to start planning for their transition.

Right away they began a 1-year discovery process which included reviewing the Big I-Reagan Best Practices Study, attending conferences, and engaging with other agency consultants to fully understand all of their options.

Once they had a good handle on their options, they strategized as a team on their personal and professional future, priorities, and legacy. They mapped out their options, performed a SWOT analysis on each of the options, consulted with their families and advisors, and arrived at a decision to perpetuate their agency internally with their next generation.

So what did the Well-Planned agency do? They developed a plan for their next-generation producers to buy out the current agency principals over a 10–year period while all were working in sync together. The plan included opportunities to purchase a small percentage of ownership upfront and an incentive plan to earn additional ownership in the agency. The plan provided mentorship of leadership duties and an effective transition of key accounts and carrier relationships. The plan laid out the personal and professional upside for all of the parties if they were successful in executing the plan.

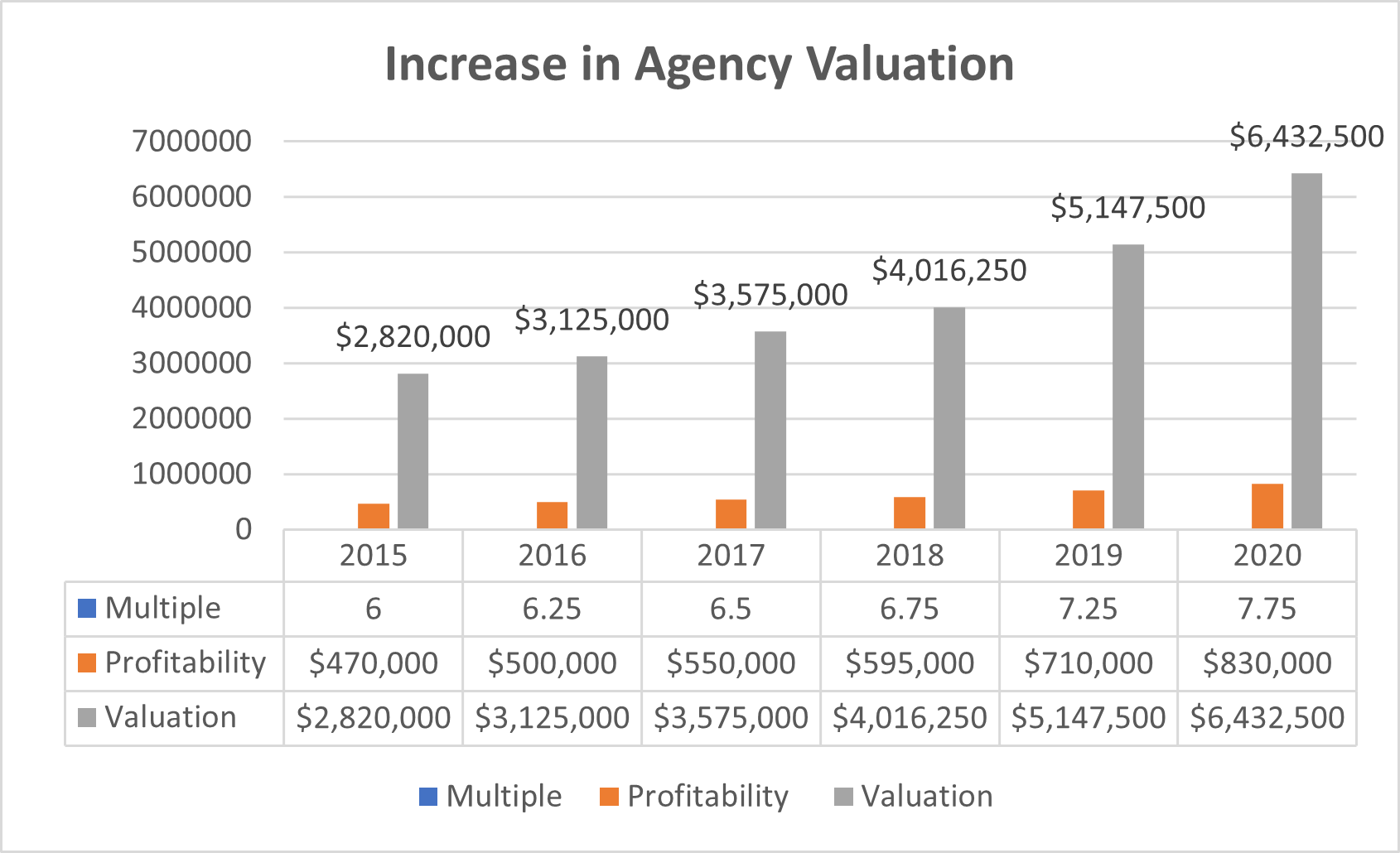

The results of the execution of the Well-Planned agency have been stunning! The agency went from flat YOY growth from 2010 – 2015 to an average of growth of 14% per year from 2015 – 2020. The profitability margin increased 76% and the valuation increased by $3,612,500 during the same time period. This was due to the strong growth, increase in profitability, bringing in the next generation of ownership resulting in increasing EBITDA valuation multiples. The following graphs more explicitly show how much the value of the agency has increased over a 6–year period.

Some of you may be saying this is not possible in my agency. You may say, we are generalists, the population in our geographic footprint is stagnant, the economy is struggling, we don’t have the next generation in our agency, our carriers don’t have an expansive appetite, we don’t have the resources to invest and we can’t defy the effects of aging. Wrong. Wrong. And wrong.

The Well-Planned Agency overcame each and every one of these dynamics. They did not change their approach to their agency, they hired very few new people, they marginally expanded their geographic footprint, the economy went through a trying time in 2020 while their agency grew and they did not add new carriers. They planned, executed the plan, and are now one of the brightest success stories in the independent agency system.

Every agency can make these same choices when faced with aging ownership. The steps to consider in overcoming aging agency ownership and increase your agency valuation include the following:

- Understand your options

- Develop a business plan for your agency to grow

- Develop a transition plan for your agency

- Develop a plan to diversify your agency ownership

In our next series, we will detail what each of these components entails and how to turn your agency valuation into a similar success story.

Conclusion

We will finish this series where we started. The data shows that $2.75 Billion of the $11.4 Billion of premium written by independent agents are controlled by 55+-year-old owners, with an average age of 63. That means 24% of the premiums written in our state are controlled by agency owners within 5 – 10 years of the traditional retirement age. While not all of this premium will change hands in the next few years, much of it will.

The bottom line, the better preparation, and planning equal higher agency value. Here are some tips for how you can get started today:

- Complete a fair market valuation of your agency – to understand where you are going you must know where you are and where you have been. A valuation will help you understand your agency’s value, identify the risk factors in your agency, and develop a plan around each one to improve upon it. We encourage agencies to make an agency valuation part of their annual business planning processes to ensure that you always have a good barometer on the value of your agency and are working on addressing the risk factors.

- Develop a formal perpetuation/transition plan – every situation must have an exit strategy, particularly something as valuable as your agency. Whatever wishes you have for your agency - internal perpetuation or external sale - you must have a plan with your exit strategy. The more planning you do in advance the smoother the process and will likely lead to capturing a higher agency value.

- Establish a contingency buy-sell agreement – this is critical for every agency but particularly for those with single owners. The contingency buy-sell is insurance for your family, employees, and clients that if the unexpected happens to you, a structure is in place to preserve the agency and its value.

- Recruit and mentor young producers and agency staff with the potential of becoming owners – recruitment of younger producers and prospective future owners is key to maximizing your agency’s value. Even if you decide to sell externally, having successful younger producers will enhance the value of your agency.

Whatever your reason for transitioning, we are here to serve you. Every agency owner will have to transition ownership of their agency at some point, despite our best effort to drink from the fountain of youth, aging is inevitable but we have the choice as to how we do so.

Let’s do so gracefully and with a plan that continues our legacy and strengthens our agencies. Please contact Jodie Shaw today to discuss your plans and how we can assist you in growing your agency value, solidifying your legacy, and fulfilling your transition plans successfully.