The greatest competitive advantage for local, privately held retail agencies (local agencies) is becoming their greatest competitive disadvantage in the rapid consolidating IA system.

As we have discussed in previous articles, mergers and acquisitions (M&A) are at record levels without any sign of significantly slowing (average of 551 M&A transactions annually in the past 10 years). The IA system is undergoing massive consolidation resulting in a fundamental realignment of the IA business model. What is being sacrificed in this realignment is independent ownership of an agency business.

The opportunity to own your business has been a hallmark for recruiting new people into the IA system and profession. It has made the IA system incredibly attractive to hard working, independently minded entrepreneurs. The type of people who love the idea of owning their own agency, calling the shots and being rewarded and held accountable for their output.

Yet, thousands of agency owners have recently traded in business ownership for employment with a larger PE backed enterprise. They are doing so for a plethora of reasons, including reaching the age of retirement, record high agency valuations, lack of an internal perpetuation plan, wanting greater scale and resources, getting rid of the challenges of running a business and back to focusing on selling insurance. Whatever the reason, agency owners are trading in the majority ownership title and responsibilities for the role of manager and employee in PE backed entities.

However, in most instances when agency owners sell to a PE buyer, they are required to take 15 – 25% of the purchase price in stock in the PE entity. There are many reasons why PE buyers require this but the primary one is that PE buyers want the selling owner to stay hungry, financially motivated and carry on the owner-entrepreneur mindset that made them an attractive acquisition prospect in the first place.

Based on our experience advising agency owners on buying and selling agencies, we are seeing a stark contrast in the approach between PE buyers and local agencies on the issue of offering equity during the transaction. Local agencies have been reluctant to offer equity to the seller in the surviving entity despite what competitors are doing and what logic and data tell us is a best practice. The net result is we believe this puts local agencies at an even greater disadvantage in the acquisition game. Let’s explore further.

According to the 2022 Agency Universe Study, 74% of the agencies in the US are $1.25M in annual revenue and smaller so for the purposes of this article we are going to focus the analysis on that group.

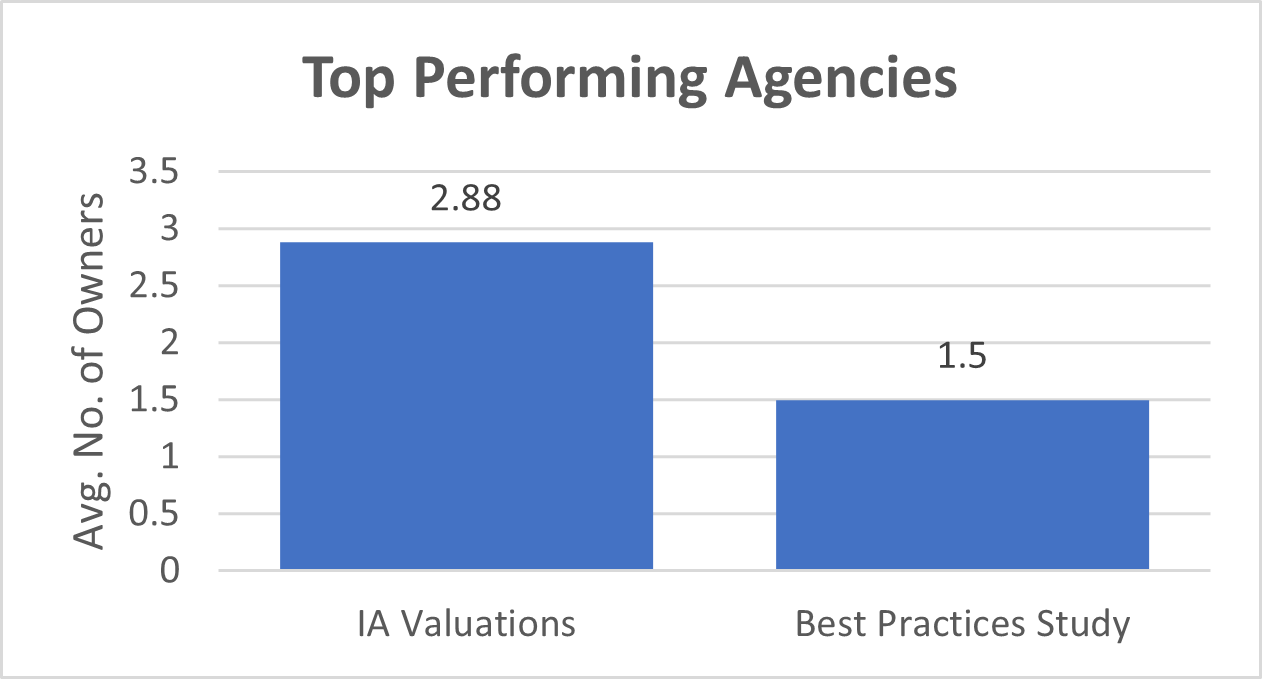

Based on IA Valuations data, we know that the top performing agency valuations have the common characteristic of having multiple agency owners. Our data shows an average of 2.88 owners amongst our highest valuation agencies.

Based on IA Valuations data, we know that the top performing agency valuations have the common characteristic of having multiple agency owners. Our data shows an average of 2.88 owners amongst our highest valuation agencies.

In addition, the 2022 Best Practices Study shows that agencies under $1.25M have an average number of 1.5 shareholders in their business. While the data shows that the best performing agencies in the US have multiple owners in the agency, extending ownership to a seller is not often considered during a local agency acquisition offer.

This is a missing ingredient to local agencies competing with PE firms for acquisitions. We believe local agencies should consider equity as part of the equation for the following reasons: it keeps the seller financially invested in the success of the surviving entity, it levels the playing field with PE buyers, you get another partner with a growth mindset with a stake in the agency and it gives the seller the proverbial “second bite at the apple.” For all the reasons the acquirer likes owning the agency, the seller has a similar love for ownership. Keeping that ownership passion ignited could lead to greater growth and prosperity post-acquisition.

That being said, the decision to bring in an outside, relatively unknown party into your agency ownership is probably one of the most difficult decisions in business and second only to vetting your spouse in terms of life decisions. There are many stories about agency breakups when the partners were not the right cultural fit. These stories likely are a big reason why many agency owners are so reluctant to offer ownership as part of the acquisition strategy.

Knowing that, we still believe it is worth considering making equity part of your acquisition strategy if you can develop the right vetting process and you want to remain competitive with PE for acquisitions. There are many arrangements you can configure when bringing in a new partner to ease the potential burden in the case of a breakup. Specifically, creating different classes of shares, creating a second entity (LLC, C Corp or S Corp) and modifying the operating agreement to reserve management and rights for the majority owner. We recommend working with your legal counsel to explore those options and from the context of planning for the worst-case scenario.

Conclusion

The distribution of ownership has proven to show immense benefits for agencies. Broadly held ownership shows a commitment to reinvest in the agency and offering stock to key employees. Ownership is a better tool than any non-compete/non-piracy agreement.

As we discussed, local agencies are competitive with PE buyers on up front purchase price but are coming up short as it relates to the long-term financial benefits. The most distinguishable discrepancy between local agencies offers and PE buyers is equity.

For local agencies, equity is your weapon to compete. It is the missing ingredient in your secret recipe to building a bigger business through acquisition, recruiting producers and harnessing the power of the entrepreneur owner.

To rethink your acquisition efforts and creative ways to leverage equity as part of your strategy, please connect with Jeff Smith, JD, CIC at jeff@iavaluations.com.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.