The headline for the Ohio Commercial Insurance Market heading into 2025 is overall continued stability. Despite ongoing pressures from a hard market—rising premiums, challenging loss ratios, and tighter underwriting—the Ohio commercial insurance market continues to demonstrate resilience and competitiveness. Independent agents remain a critical force in the state, responsible for writing nearly 90% of all insurance for Ohio businesses. In fact, during 2024, independent agents controlled 64.5% of the Ohio P&C marketplace. This compares to the United States average of 61.5%.

2024 Market Overview

In 2024, Commercial Multi-Peril (CMP) was the third largest line of business written by Ohio’s independent agents, following Private Passenger Auto and Homeowners. Across all P&C lines, Ohio reported an average loss ratio of 58.3%, slightly outperforming the national average of 62.3%. The highest loss ratios were seen in Products Liability (94.6%), Private Crop (90.4%), and Other Liability (Occurrence) at 75.0%. These results reflect broader national trends in legal system abuse, weather volatility, and rising claims severity.

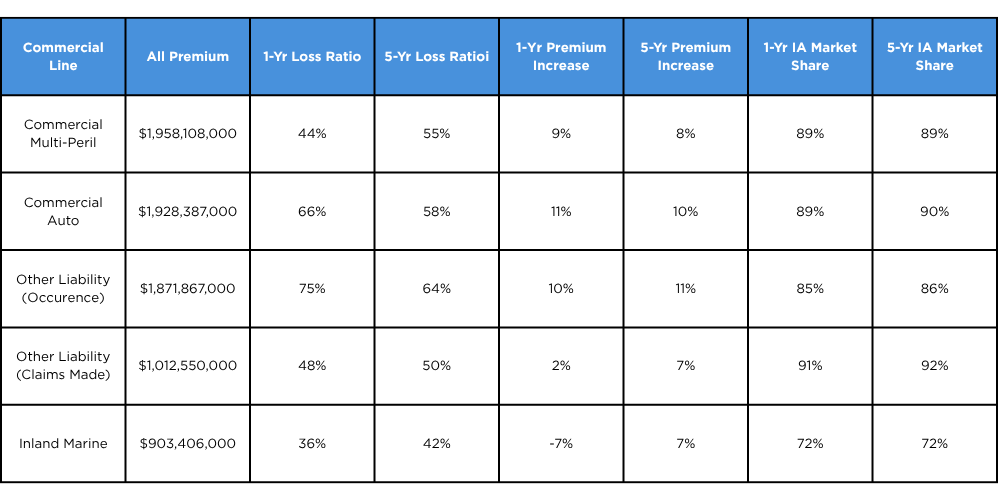

Here’s a summary of the top five commercial lines by total premium in Ohio:

(Source: A.M. Best Company)

The highest premium increase in 2024 came from Commercial Auto (+11.1%), which continues to see worsening claims frequency and severity, particularly in liability-related losses. Inland Marine saw a 7% decrease in DWP from 2023 to 2024 for the state of Ohio. Some of this may be due to a downward trend in loss ratio, but there are also new inland marine markets entering the space that are offering competitive rates to try to gain market share.

Loss Ratio Pressures

Ohio continues to face the same trends as the broader market, including economic inflation, severe weather, increasing severity of commercial auto claims, and social inflation, such as societal and legal trends that lead to larger jury awards, settlements, and increased litigation costs.

Ohio saw a significant increase in the loss ratio over the five-year average in both Commercial Auto and Liability (Occurrence). Commercial Auto liability continues the decades long trend of loss and loss adjustment expense ratios developing adversely every year since 2016. The increased frequency and severity of storms led to significant losses in multi-peril crop (55%, 21 pts over the five-year average), private crop (90%, 15 pts), and Federal Flood (28%, 9 pts).

An especially concerning trend is the 95% loss ratio in Products Liability, driven by a much larger litigious environment. To help address this, OIA’s Advocacy Team is actively engaging with the Ohio Legislature on improving transparency around third-party litigation funding.

The few bright spots running below the five-year average were ocean marine (22 pts), burglary and theft (14 pts), and inland marine (6 pts). These areas may provide some strategic opportunities for carriers and agents as they seek more stable, profitable lines within commercial P&C.

Commercial Group Leaders

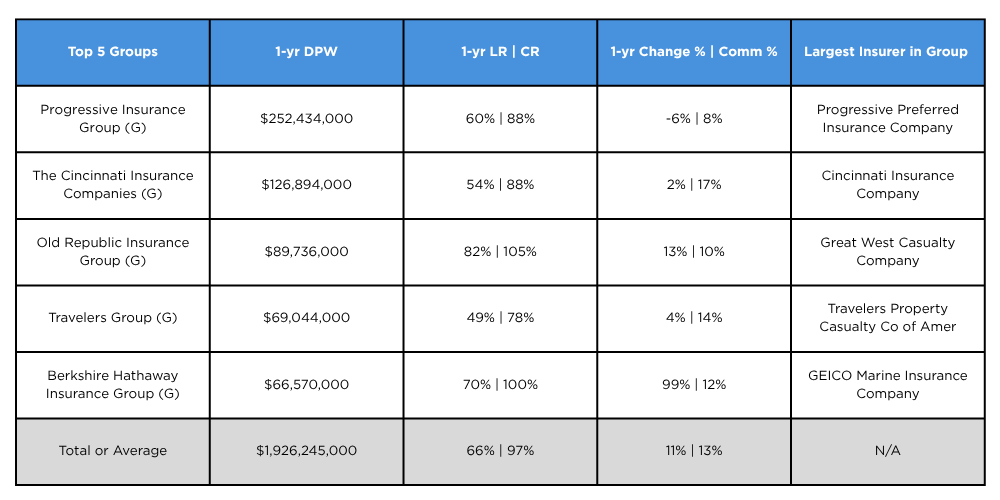

Insurer groups leading the pack in the commercial P&C space did well for themselves last year with moderate loss ratios and DPW totaling nearly $2B in both commercial multi-peril and commercial auto. The commercial lines were led by familiar top insurer groups in terms of direct premium written (DPW). For Commercial Auto, Progressive Insurance Group—unsurprisingly, given its branding as the “#1 commercial auto insurer”—led the market with $252.4 million in DPW, nearly doubling its closest competitor, The Cincinnati Insurance Companies, which brought in $126.9 million. Access the full list of commercial auto P&C insurers in Ohio here, provided by A.M. Best Company.

Commercial Auto Group Leaders (Source: A.M. Best Company)

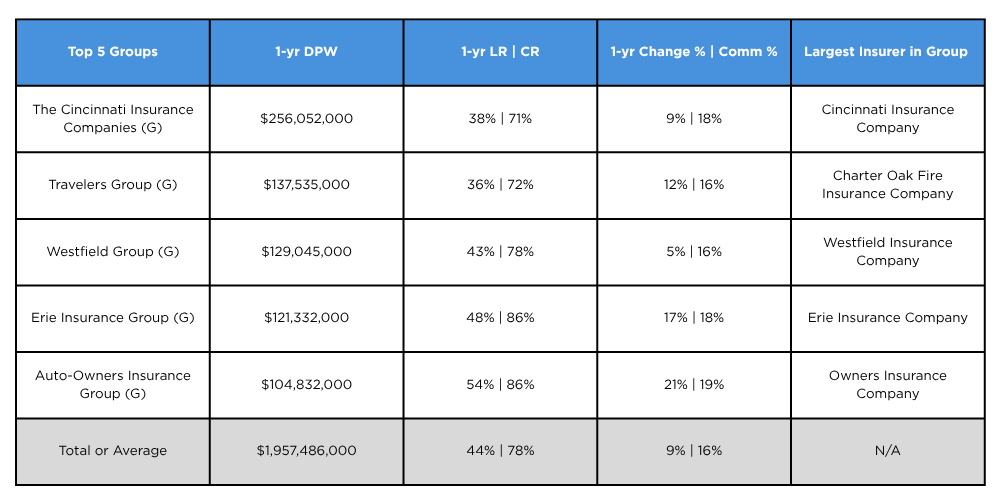

In the Commercial Multi-Peril category, The Cincinnati Insurance Companies took the top spot with $256.1 million in DPW, followed by Travelers Group at $137.5 million. Review the full list of commercial multi-peril P&C insurers in Ohio here, provided by A.M. Best Company.

Commercial Multi-Peril Group Leaders (Source: A.M. Best Company)

How Can Agents Respond to Commercial Market Trends?

Independent agencies are in a strong position to continue their stride in commercial insurance—especially in Ohio, where they write nearly 90% of all policies. But to stay ahead in a competitive and evolving market, agencies need to be intentional in how they educate, operate, and grow.

One critical area is client education. Agencies should take a proactive role in helping clients understand the impact of legal system abuse on insurance rates in particular. This includes explaining how predatory attorneys can exploit the claims process and ultimately drive up premiums. Tools like the Trusted Choice Legal System Abuse Toolkit can help agents navigate these conversations.

To ensure commercial insurance remains a central part of your agency’s growth strategy, consider doubling down on industry specialization. Building deep knowledge in a specific sector allows you to become a trusted advisor and risk expert—setting you apart from generalists and positioning your agency as a go-to partner.

Operational efficiency is also essential. Commercial insurance is a relationship-driven business, and every hour spent chasing documents or handling administrative tasks is time not spent nurturing clients or prospecting new ones. Hiring an operations leader, office manager, additional staff, or even a virtual assistant can free up valuable time, allowing producers to focus on what matters most: growth and client service.

Did you know? It’s projected by the Ohio Department of Insurance that the insurance industry in Ohio will have a need for nearly 108,000 new workers between 2021 and 2031. It’s best to create a game plan ahead of time!

Finally, invest in developing commercial talent. The demand for skilled Commercial Account Managers and Producers continues to outpace supply. Use tools like personality assessments (such as IdealTraits) to identify candidates with the potential to succeed in the commercial space. Once onboarded, make sure they receive proper training, growth opportunities, and competitive compensation to keep them engaged and thriving.

Despite ongoing market pressures, Ohio’s commercial insurance landscape continues to show strength, with independent agents playing a central role in that stability. Looking ahead, the agencies that invest in talent, sharpen their focus and competitive edge, and stay proactive in client education will be best positioned to thrive—both in the market today and in the one taking shape tomorrow.

About the Author

Brian Lawrence is the Sr. Director of Agency Talent Development for Ohio Insurance Agents. He is responsible for providing HR support and resources for the membership. His HR career spans 25 years across Insurance, Financial Services, Healthcare, and Association Management.

Brian Lawrence is the Sr. Director of Agency Talent Development for Ohio Insurance Agents. He is responsible for providing HR support and resources for the membership. His HR career spans 25 years across Insurance, Financial Services, Healthcare, and Association Management.

Much of his experience includes 20 years at Nationwide, where he spent seven years as an HR Director/HR Business Partner providing strategic support to executive leadership teams across P&C, Commercial and Non-Standard Customer Service Operations, Life Insurance and Annuity Operations, & Nationwide Pet Insurance.

Sources:

This report summarizes 2024 data available from the A.M. Best Company report released June 1, 2025 and the Ohio Marketplace report prepared by Real Insurance Solutions Consulting, LLC. Principal: Paul A. Buse – Website: www.realinsurancesc.com – Contact Information: 301-842-7472