Two of the most pressing issues in the independent agency system at the present moment are growth and talent acquisition. We strongly believe these two roadblocks are intertwined. Many owners are actively searching for and recruiting next-generation talent, but the industry and its potential for a rewarding and fruitful career remain a best-kept secret. Owners have tried various approaches, and when disappointed with the results, essentially abandon the idea of backfilling NextGen talent and potential future agency owners.

Additionally, in our work advising both buy-side and sell-side transactions through IA Valuations, our consulting arm, we have noticed a sea change in post-deal operations/integration. Ten years ago, it was common for an agency acquirer to purchase an agency, cut jobs, and re-route the work to call centers. Those practices have changed dramatically in the past few years. Now, acquirers are looking at acquisitions not just in terms of buying a book of business, but rather, at acquiring talented insurance professionals along with the book.

On a hunch that agencies are not being competitive in their pay and benefits offering compared to other industries, we decided to look at our proprietary IA Valuations database to see what agencies are doing in regard to paying benefits, both retirement and non-retirement benefits. We thought by comparing the data, we might find some answers as to why agencies are struggling to break through and hire high-potential talent.

No Retirement Benefits Paid

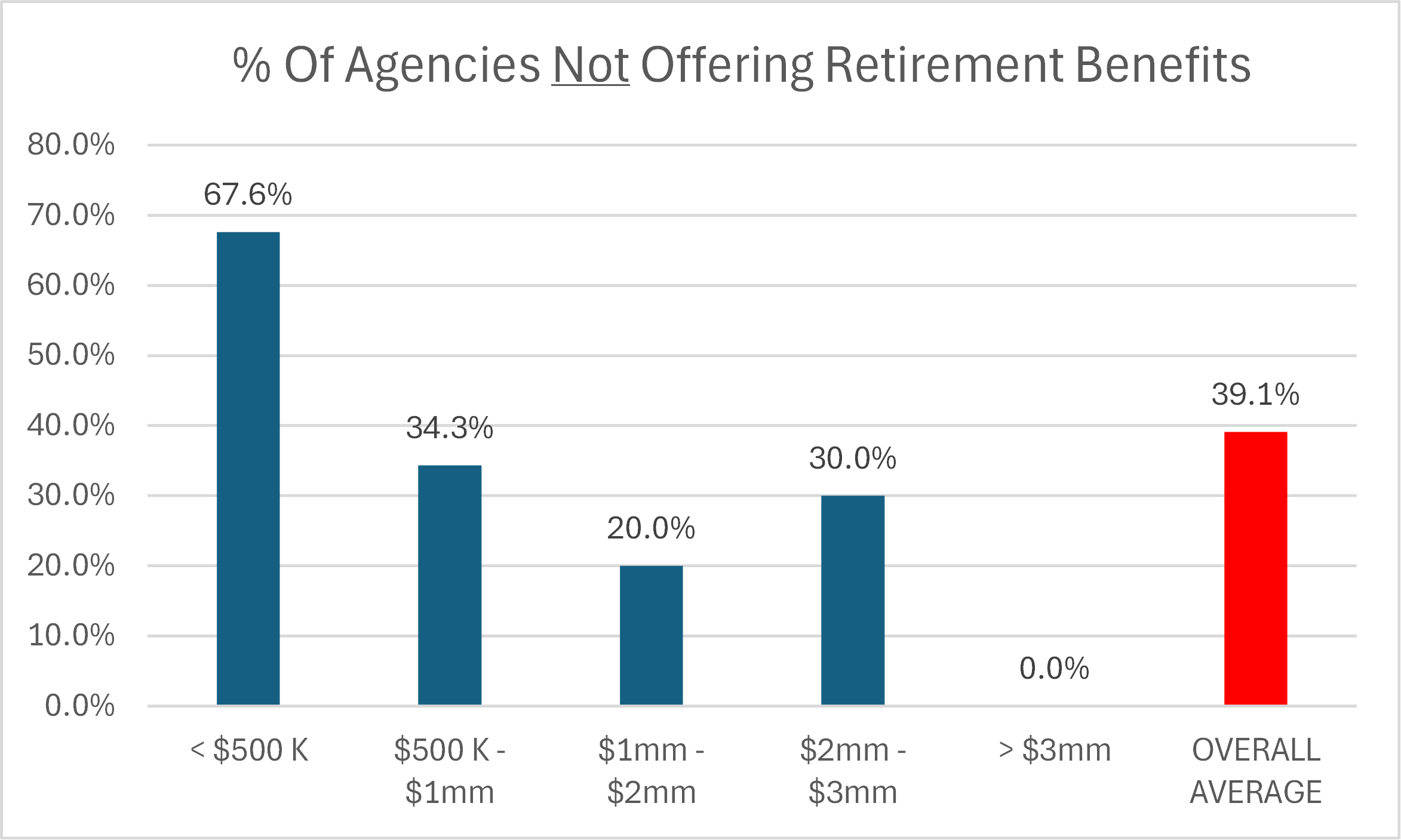

Our first exercise was to take a look at the number of agencies that are paying zero in retirement benefits. We divided the database into various revenue bands and looked at the percentage of agencies that are not paying anything at all in terms of retirement benefits.

Overall, we see that nearly 40% of all agencies do not pay any retirement benefits. The smallest agencies by revenue are the least likely to offer benefit, while 100% of the agencies with over $3M in revenue offer some form of retirement benefits.

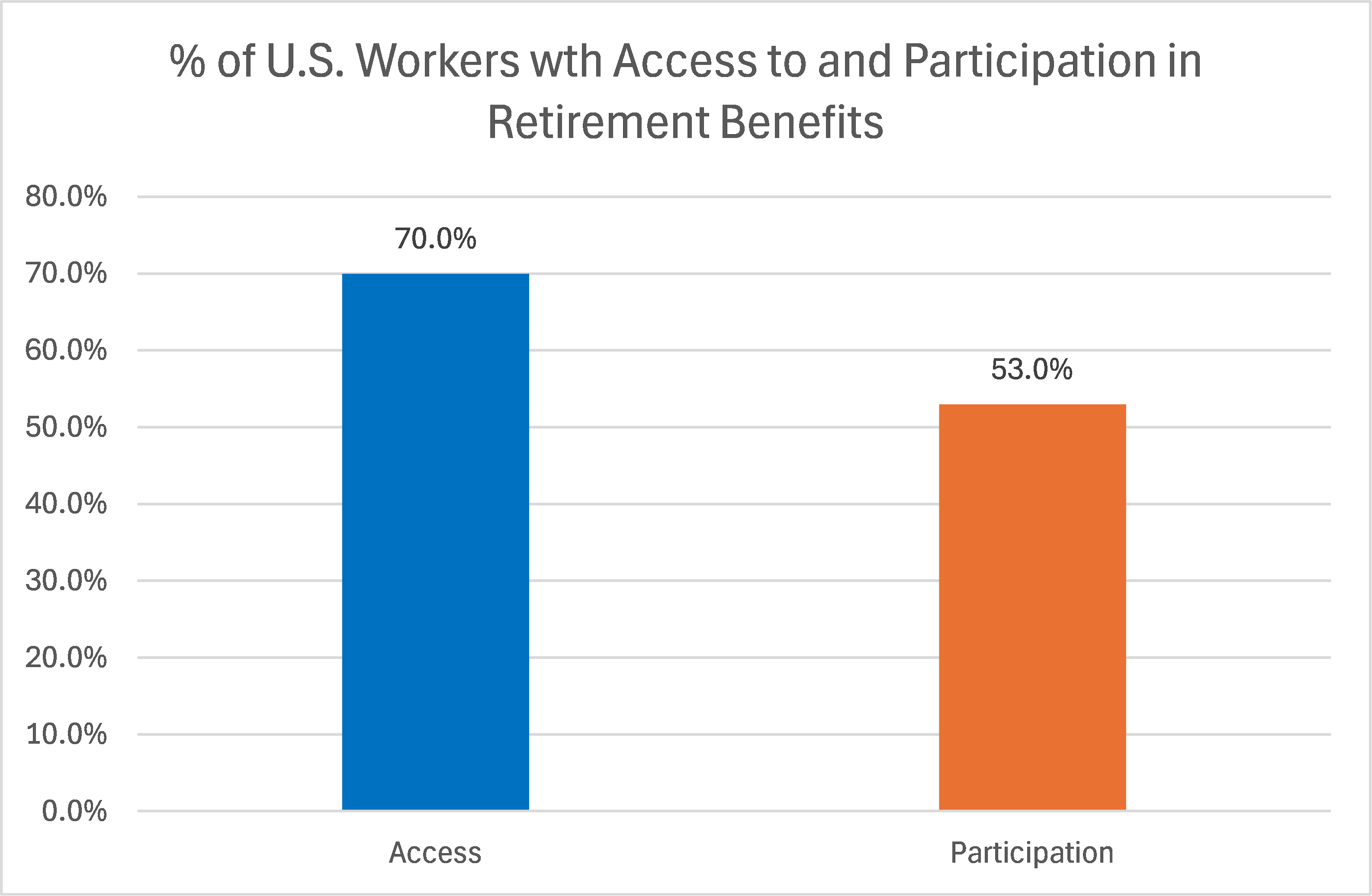

Now, contrast those numbers with a view of all employees nationwide. According to the U.S. Bureau of Labor Statistics, as of March 2023, the percentage of U.S. workers with access to retirement plans was 70%. That is 30.9% greater than our agency-universe average, nearly doubling the access rate from our data.

Meanwhile, according to a recent study published in Fast Company, 93% of employees say that retirement benefits, such as 401k, influence their decision to join a company. 50% say they would turn down a job that does not offer this benefit. Given the high percentage of agencies not offering some form of retirement benefits, we see a great opportunity for agencies to improve their competitiveness in attracting new talent.

Reasons Employers Do or Do Not Offer Retirement Benefits

There are many actors that influence a company’s decision to offer, or not offer, retirement benefits. According to research by the Pew Research Foundation, there are two main factors:

- Cost – Compared to larger employers, small businesses tend to pay higher fees. This is because spreading the cost across more plan participants typically results in lower fees, and plans with greater assets often benefit from reduced expenses.

- Time – Administering a plan can be time consuming to manage and smaller employees often don’t have a dedicated staff member in charge of managing the retirement benefits.

While these factors are certainly obstacles for a small business, there is a good chance the agency will see a return on investment and benefit long-term by attracting and retaining higher caliber employees.

For Those Agencies Offering Benefits, How Much Are They Spending?

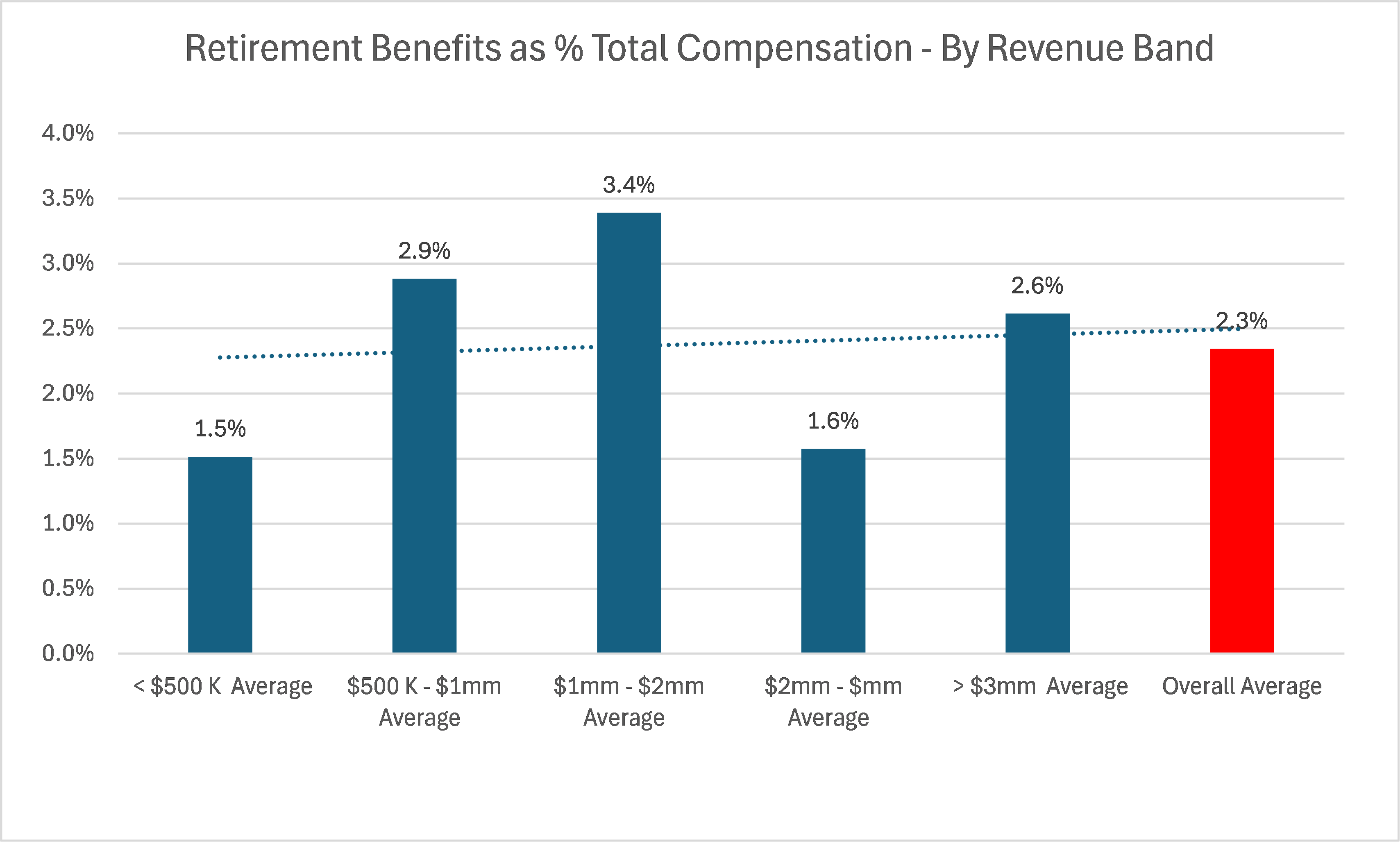

For the independent agencies that are offering retirement benefits, how does their spending track with other industries? We pulled the data, by revenue band, to give you an idea of what these agencies are spending.

The chart above shows the amount spent on retirement benefits as a percentage of total compensation. The trend line shows an average right around 2.3%, which is near the total overall average.

Comparing Independent Agencies to the Overall Market and the Insurance Sector

The Bureau of Labor Statistics provides data on the overall benefits paid to private industry workers and individual sectors.

The graph above shows the amount spent on retirement benefits as a percentage of total compensation. This demonstrates that independent insurance agencies are lagging not only in the total private employer market, but also in the Finance & Insurance sector.

Options for Small Agencies

For small businesses that think they cannot afford to offer retirement plans to their employees, there are options available that will give you flexibility in meeting your needs. Examples include:

- Self-Employed 401Ks: These plans are designed for self-employed small business owners with no employees other than a spouse. Funding these accounts comes from a combination of employee deferrals and contributions.

- SEP IRAs: Designed for individuals or small business owners with a small number of employees, these IRAs are funded solely by employer contributions.

- Simple IRAs: These help self-employed individuals and small business owners gain access to tax-deferred benefits when saving for retirement.

- Pooled Employer Plans: These plans allow for multiple unrelated employers to participate in one 401k plan. This works to reduce the cost and administrative work that may prohibit a business from offering a traditional 401k.

The Way Forward

Independent agencies have struggled for many years to find quality talent to replace an aging workforce. Many factors contribute to this, and it appears that compensation and benefits could be a major factor. For the agencies that are struggling to find talent, but are not paying any benefits at all, or are paying below market benefits, this is your call to action. We often say the independent agency world is a best-kept secret, and those who find it will have an opportunity for a satisfying and lucrative career. To ensure that you have the talent to continue your agency into the next generation, it is time to start offering pay and benefits that will attract and retain the best and brightest talent.

Need Help Hiring?

To help better meet our members’ growing need for hiring and retaining talent, OIA worked in collaboration with IdealTraits to create the OIA Job Board! Through both paid and free plans, OIA members can post their jobs and manage applications all through the platform, providing a more streamlined hiring process.

As an OIA member, you also have membership to the Big “I” and you can learn more about Big “I” Retirement Services.

Reach out to Brian Lawrence, Director of HR Solutions, if you have any questions about hiring and retaining talent. You can also reach out to Craig Niess, Director of Business Planning & Valuations for OIA and IA Valuations, if you want to discuss where your agency currently sits and opportunities for growth.

About the Authors:

Crag Niess is the Director of Business Planning & Valuation for IA Valuations. Between his time with OIA/IA Valuations and MarshBerry, Craig has over a decade of financial and operational consulting experience with independent insurance agencies. He has advised many independent agency owners on their transition and perpetuation plans, created financial models to support an ownership transition, and developed producer hiring and business planning for agency growth. In addition, he has completed hundreds of valuations and consulting projects for independent agencies of all sizes. He holds a BA in Economics from Ohio Wesleyan University and an MBA in Finance from the University of Iowa. He also earned the highest and most prestigious designation in the valuation profession – the Certified Valuation Analyst designation.

Crag Niess is the Director of Business Planning & Valuation for IA Valuations. Between his time with OIA/IA Valuations and MarshBerry, Craig has over a decade of financial and operational consulting experience with independent insurance agencies. He has advised many independent agency owners on their transition and perpetuation plans, created financial models to support an ownership transition, and developed producer hiring and business planning for agency growth. In addition, he has completed hundreds of valuations and consulting projects for independent agencies of all sizes. He holds a BA in Economics from Ohio Wesleyan University and an MBA in Finance from the University of Iowa. He also earned the highest and most prestigious designation in the valuation profession – the Certified Valuation Analyst designation.

Brian Lawrence is the Sr. Director of Agency Talent Development for Ohio Insurance Agents. He is responsible for providing HR support and resources for the membership. His HR career spans 25 years across Insurance, Financial Services, Healthcare, and Association Management.

Brian Lawrence is the Sr. Director of Agency Talent Development for Ohio Insurance Agents. He is responsible for providing HR support and resources for the membership. His HR career spans 25 years across Insurance, Financial Services, Healthcare, and Association Management.

Much of his experience includes 20 years at Nationwide, where he spent seven years as an HR Director/HR Business Partner providing strategic support to executive leadership teams across P&C, Commercial and Non-Standard Customer Service Operations, Life Insurance and Annuity Operations, & Nationwide Pet Insurance.