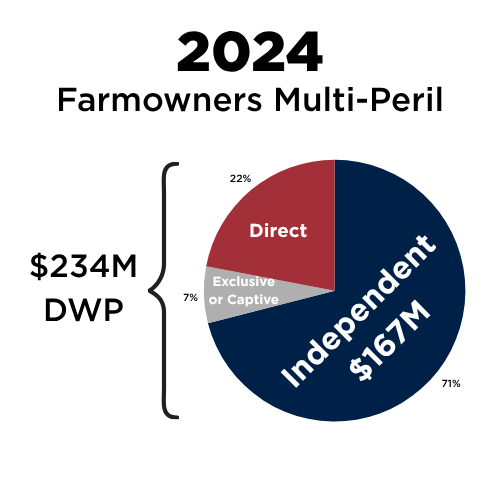

Over the past five years, from 2020-2024, the Farmowners Multi-Peril marketplace has steadily grown by an average of 6% in direct written premium each year, and the independent agent penetration rate has stayed strong at an average of 70% of the market share.

For the purposes of this article and the data presented, “Farmowners Multi-Peril” (which we’ll shorten to “Farmowners”) is defined to include:

- “A package policy for farming and ranching risks, similar to a homeowners policy, that… includes both property and liability coverages for personal and business losses;” and

- “A commercial package policy for farming and ranching risks that includes both property and liability coverage.”

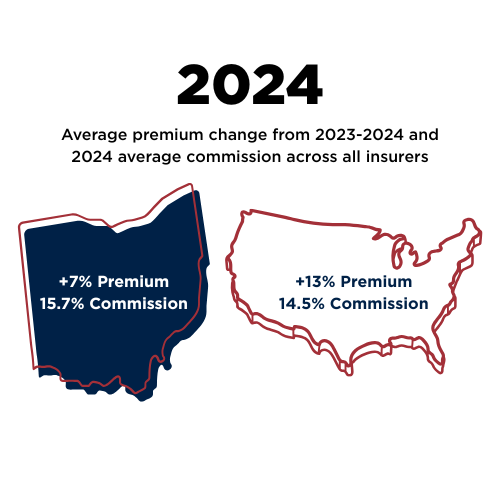

In 2024, the state of Ohio saw a total of $233,869,000 in direct written premium (DWP) for the Farmowners marketplace, increasing by 7% from 2023. Independent agents continued to make up the majority of that figure at 71% of the market share, totaling $167,112,000 in DWP. Exclusives and captives only make up only 7% of the total DWP and the remaining 22% is written direct to consumer, supplied entirely by Nationwide Agribusiness Insurance Co.

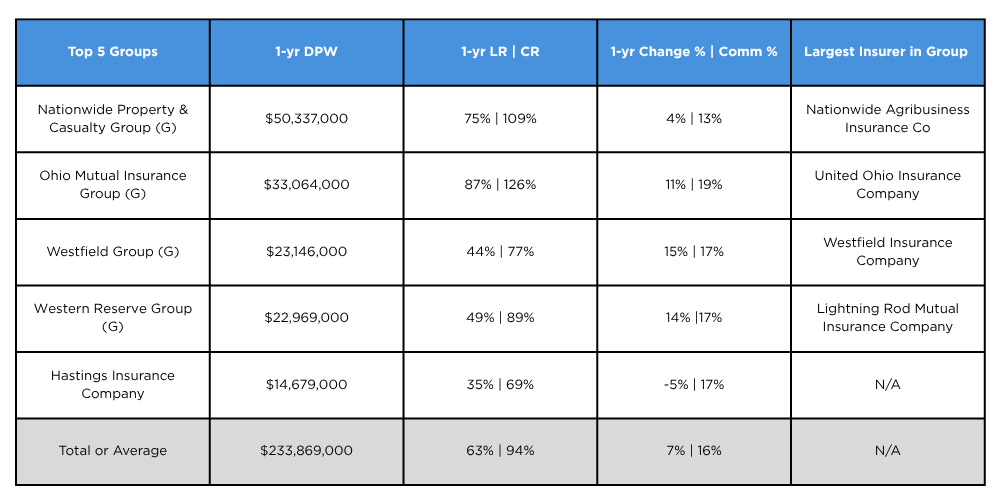

The Adjusted Loss Ratio for the Farmowners marketplace was 46% in 2020, 45% in 2021, and then spiked to 72% in 2022. It remained high in 2023 at a 78% loss ratio and an average carrier Combined Ratio of 110%. Fortunately, 2024 saw the marketplace come back down to an Adjusted Loss Ratio of 63%.

From what we learned from our carrier partners, the spike in loss ratio for 2022 and 2023 can be attributed to weather-related claims. Western Reserve Group specifically cites an “increase in the frequency and severity of straight-line wind events and hail events.” Westfield Group adds that 2022 saw “a sharp increase in CAT related storms – severe convective storms, wind/hail, tornadoes,” as well as “supply chain issues and inflation [which] increased the average claim payout.”

The average commission percentage for Farmowners across all insurers has decreased from 16.6% in 2023 to 15.7% in 2024. However, insurers typically include contingencies in their by-state commission figures, so we should consider the drop in commission could be impacted by a change in the contingency figures. It’s also important to note that Ohio remains competitive in the Farmowners space compared to the U.S. as a whole. Nationally, the Farmowners marketplace experienced an average commission of 14.5% for 2024.

Carrier market leaders in Ohio

The top 5 insurer groups in the Ohio Farmowners space, ranked by DWP, are:

- Nationwide Property & Casualty Group

- Ohio Mutual Insurance Group

- Westfield Group

- Western Reserve Group

- Hastings Insurance Company

As leaders in the Ohio Farmowners space, we reached out to a few of these carriers to get their perspective and experience. All reported that they are experiencing similar trends to what the Ohio data is showing us but have a positive outlook on the future of the marketplace.

Q: Do you think loss ratios will continue to level back out to where they were in 2020 and 2021?

Western Reserve: “We do expect to see improved results in 2025 and beyond. Given the results the industry has experienced in Ohio, we’ve seen the industry implement several profit improvement initiatives around roof settlement terms, wind/hail deductibles, rate, and other areas to help manage the overall CAT exposure that carriers in the state have seen.”

Westfield Group: “The weather is always an unknown. However, our average rate levels have increased substantially since 2020, accounting for the increased cost to repair/replace damaged farm property. We are also using terms/conditions that help us manage the overall loss ratio better. Viewing Ohio farm performance from a long-term perspective, it is a favorable state to do business for this product.”

Q: What trends are you seeing in the Farmowners marketplace?

Western Reserve Group: “Consolidation within agriculture is a key trend that we see. Essentially, we are seeing larger, more complex farm exposures today as compared to what we’ve seen historically. This has led to larger exposures and a more complex Farmowners insured, both from a property and liability perspective.”

Westfield Group:

- “Farmers are seeking alternative revenue streams such as agritainment to supplement their farming activities;”

- “‘Barndomiums’ AKA barns that serve other purposes than traditional farming are becoming more common. Often these are rented out as VRBOs or used as wedding venues. This creates unusual exposures for us that a farm product is not built for and so we have to charge separately for the exposure;”

- “Raising ‘wild game’ has increased (buffalo/bison, deer);” and

- “Hunting exposure on farm land.”

Ohio Mutual Insurance Group: OMIG shared that they’re seeing an increase in agritrainment and agritourism operations, small & hobby farm growth, and increasing weather volatility. They also shared a few additional, very interesting trends they’re noticing:

- Diversified Revenue Streams: “One growing trend is the rise of custom farming services… Additionally, many are using their farm trucks and trailers for commercial hauling, transporting commodities, livestock, or supplies for other operations. These side ventures… shift the nature of risk from personal or farm use to commercial exposure.”

- Unmanned Aircraft/Drone Chemical Spraying: “These agricultural drones, also known as UAV sprayers or ag drones, can cover fields quickly with targeted applications of fertilizers, herbicides, and pesticides, which reduce chemical waste, minimize soil compaction, and also reduce costs. However, most traditional farm insurers can’t provide coverage for UAVs that spray, which is forcing farmers to obtain coverage through specialty aviation companies.”

- Farmland being leased to solar companies: “When farmland is used for solar energy projects, the land use classification typically shifts from agricultural to commercial or even industrial… In many cases, solar companies require farmers to add them as an additional insured and include a waiver of subrogation, which places added liability exposure on the farmer, despite the farmer only owning the land. These contractual insurance requirements can be difficult to meet, as many farm insurers are unwilling to provide the endorsements or coverage extensions that the solar company demands. Often, farmers sign lease agreements without first consulting their insurance agent, which can create major issues with coverage and contract compliance once the project is underway.”

Q: What factors are going to affect the future performance of this line of business?

Western Reserve Group: Weather experience and how carriers manage this exposure will continue to have a significant impact on the future performance of Farmowners.

Westfield Group: “Multiple factors contribute to future performance including:

- CAT activity (severe convective storms, tornados, wind/hail);

- Ag economy – when the Ag economy struggles, farmers must reduce insurable exposures, seek alternative revenue streams, seek alternative insurance options, etc.;

- Legislative issues can negatively impact our performance, e.g. environmental issues such as pollution related to farming practices;

- Social inflation; and

- Reinsurance availability and cost.”

Q: How can agents better guide their policyholders in the Farmowners marketplace?

Western Reserve Group: “The Farmowners marketplace requires a unique skillset from an agency perspective. Whether you are working with a client who operates a dairy farm, a crop farm, or a livestock farm, developing a deep understanding of agriculture and the unique risks associated with these operations is critical. Sitting down, often at the kitchen table, with farm customers to understand their unique challenges will help the agent guide their customers down the right path. This segment of the marketplace is very relationship-oriented, requiring ongoing interaction and periodic visits to the farm, especially larger farm operations. As the marketplace evolves, understanding carrier specific product offerings in this space is vital. For example, carriers have begun implementing Actual Cash Value settlement terms on roof damage resulting from a wind/hail event. Customers need to understand the impact that has on a claim, and what they can do to help manage and mitigate their risk with the carrier.”

Westfield Group:

- “Use sound risk management practices in operating your farm;

- Increase self-insurance retention (deductibles, absorb maintenance type losses);

- Leverage industry advocates/trade associations;

- Build back better – don’t cut corners when installing new buildings/equipment;

- Get to know your insurance carrier – know what they do well and make sure they understand Ag/Farm;

- Take advantage of what your insurance carrier has to offer that goes beyond the traditional product offering – risk control, Ting device, premium discounts, pay-as-you-go workers’ comp, etc.”

Ohio Mutual Insurance Group:

- Informed Strategic Insurance Advisors: “Insurance agents must take a big-picture view, staying informed and engaged to tailor coverage that fully protects all aspects of the farm and adapts as the operation grows or changes.”

- Regular, Year-Round Reviews and Communication

- Farmer Education is Critical: “With more policy changes like Actual Cash Value (ACV) adjustments, Cosmetic Damage Exclusions, and narrowed coverage terms being added to insurance contracts, education is more important than ever.”

- Set Expectations and Document Coverage Conversations

The future of the Farmowners Multi-Peril marketplace in Ohio will depend both on weather events and, maybe more importantly, on how carriers will manage exposures as farm risks continue to evolve. But agents have an opportunity to impact the course of the Farmowners marketplace.

Take time to carefully evaluate a farmowner’s operations and hazards. Sometimes observing their practices is the only way to do that, so it’s important to actually step foot on the premises. Have conversations with clients about their unique exposures and educate them on risk management opportunities. Be sure to understand the products you’re recommending, as they’ll differ from carrier to carrier. But don’t forget to lean on your carrier partners to provide education, training, and resources that can benefit both you and your clients.

About the Author:

Cristie is a licensed Property, Casualty, Life, and Health insurance agent. Before joining the OIA, she worked at an independent agency in southern Ohio for over eight years. Her favorite thing about the insurance industry are all of the wonderful people she gets an opportunity to meet and now she enjoys the opportunity to help the agents she used to work alongside.

Sources:

This report summarizes 2024 data available from the A.M. Best Company report released June 1, 2025 and the Ohio Marketplace report prepared by Real Insurance Solutions Consulting, LLC. Principal: Paul A. Buse – Website: www.realinsurancesc.com – Contact Information: 301-842-7472