The insurance industry offers various pathways for growth and collaboration, particularly for independent agents and agencies. Among the most prominent structures are insurance clusters, aggregators, alliances, and franchises. Each option has distinct advantages and challenges, making it essential to understand them to make informed decisions that align with your business objectives.

Insurance Aggregators

Aggregators focus on pooling premiums from member agencies to secure better terms with insurers. Member agencies benefit from competitive commissions, centralized services, and access to advanced tools, streamlining their operations.

Pros:

- Commissions: Enable better commissions through pooled premiums.

- Negotiation Power: Collective bargaining strength.

- Services: Access to administrative, marketing, and technology tools.

Cons:

- Conflicts: Disputes may arise among members.

- Fees: Costs associated with utilizing aggregator services.

- Loss of Autonomy: Independence may be limited.

Exit Costs:

- Exit Fees: Costs associated with leaving the aggregator.

- Non-Compete: Restrictions on working with certain carriers post-departure.

Insurance Alliances

Alliances are formal associations of independent agencies collaborating to share resources, reduce costs, and enhance market influence. Members retain their autonomy while benefiting from collective initiatives, such as networking and shared services.

Pros:

- Collaboration: Community and networking opportunities.

- Market Presence: Improved brand recognition and market influence.

- Shared Resources: Access to advanced tools and services.

Cons:

- Compromise: Alignment with alliance goals may be required.

- Fees: Costs for membership and participation.

- Coordination: Effective communication and cooperation are essential.

Exit Costs:

- Commitment Periods: Early departure penalties may apply.

- Exit Fees: Costs associated with leaving the alliance.

Insurance Clusters

Insurance clusters are networks of independent agencies collaborating to achieve mutual benefits while retaining their independence. Member agencies operate under their own brands but gain access to shared resources like marketing, technology solutions, and training.

Pros:

- Independence: Retain agency branding and ownership while leveraging cluster resources.

- Market Access: Improved carrier access and negotiation terms through collective bargaining.

- Support Services: Access to advanced marketing, technology, and training tools.

Cons:

- Limited Influence: Smaller agencies may have less say in cluster decisions.

- Membership Fees: Ongoing financial commitment.

- Shared Identity: Potential confusion between the agency and cluster branding.

Exit Costs:

- Book of Business: Agencies may need to buy back their book of business upon exit.

- Exit Fees: Fees often apply when leaving the cluster.

Insurance Franchises

Franchises offer a standardized business model with franchisees operating under the franchisor’s brand. Franchisees gain comprehensive support, including training, marketing, and operational resources, but must adhere to franchisor guidelines.

Pros:

- Brand Recognition: Benefit from an established reputation.

- Proven Business Model: Access to a successful and standardized system.

- Support: Comprehensive training and operational assistance.

Cons:

- Costs: Initial investment and ongoing fees.

- Loss of Autonomy: Franchisees must follow strict standards.

- Royalty Fees: Payments based on ongoing revenue.

Exit Costs:

- Exit Fees: Terminating the agreement may incur penalties.

- Non-Compete Clauses: Restrictions on business activities post-exit.

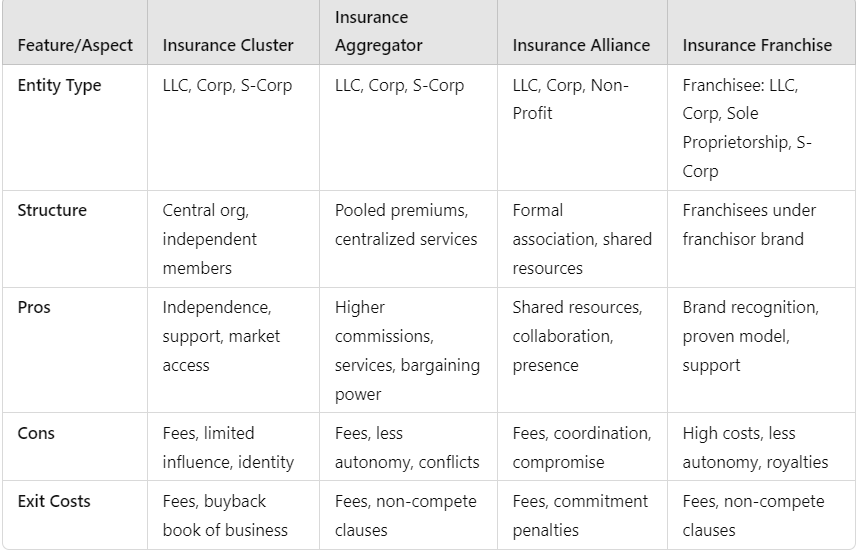

Comparison Chart:

Additional Considerations

- Goals: Align choices with long-term objectives, whether for growth, independence, or leveraging a proven system.

- Financial Health: Assess initial and ongoing costs, as well as potential exit fees.

- Market Dynamics: Evaluate local market access and compatibility with specific insurance types.

- Compliance: Stay updated on licensing, reporting, and consumer protection laws.

- Technology Trends: Explore advanced platforms to streamline operations and enhance client services.

Conclusion

Clusters and aggregators offer significant support and market access while maintaining some level of independence. Alliances emphasize collaboration and shared resources, while franchises provide a strong brand and comprehensive support but require greater financial commitment. Carefully considering these factors will help you make the best decision for your business.

For further assistance, contact Jeanie Giesler, Resource Center Advisor, at jeanie@insuranceagents.com or call toll-free (800) 555-1742 or direct at (614) 552-3054.

Legal Disclaimer: This material is intended to provide you with general background and insight. The material does not constitute, and should not be regarded as, legal advice regarding any particular facts, circumstances, or issues. This material is not intended to serve as a substitute for legal counsel, and we advise you to contact legal counsel for specific analysis, drafting, and advice.

More Information: Seek your trusted advisors Attorney, Banker, and CPA so that your legal and financial interests are adequately protected. The information provided in this publication is not intended to be a substitute for legal advice. You should consult your legal counsel and make certain that you are in compliance with state law. These laws and rules are subject to change. If you have more questions about this guide, you can contact: OIA at (800) 555-1742 for the most up-to-date information.

Cited Resources

Insurance Journal

Article: “Things to Consider When Using Agency Partnership Groups”

Date: February 10, 2020

Link: https://www.insurancejournal.com/magazines/mag-features/2020/02/10/557783.htm

Darkhorse Insurance

Article: “Exploring the Best Aggregators in Insurance and Agency Partnerships”

Date: December 5, 2024

Link: https://www.insurancejournal.com/blogs/darkhorse-insurance/2024/12/05/803609.htm

Voldico

Article: “Insurance Networks, Clusters, Alliances & Aggregators… Is There a Difference?”

Date: August 14, 2017

Link: https://voldico.com/blog/networks-clusters-alliances-aggregators/

HawkSoft

Article: “What to Consider When Joining an Insurance Agency Network”

Date: July 20 2023

Link: https://blog.hawksoft.com/evaluating-insurance-network-partners