Self-driving cars. Tariffs. Inflation. It’s no secret that the private passenger auto (PPA) insurance market in Ohio is undergoing significant shifts driven by inflation, technology, and changing consumer expectations. With rising premiums, evolving carrier strategies, and new regulatory and technological forces at play, both insurers and agents are adapting to a more complex environment. This article takes a peek into the current landscape, recent trends, market leaders, and what lies ahead for personal auto insurance in the Buckeye State.

A Snapshot of the 2024 Ohio Auto Insurance Market

In 2024, Ohio’s personal auto insurance market continued to be a major force within the state’s Property & Casualty (P&C) sector. The market mirrors national trends, where auto insurance makes up roughly 33% of all P&C premiums.

With over $9 billion in direct written premiums for private passenger auto, Ohio remains one of the top auto markets in the Midwest. Affordability, however, has become a growing concern. Average premiums rose sharply—by more than 50% in some parts of the state—due to inflation, labor shortages, parts supply disruptions, and a sharp rise in vehicle thefts. While Ohio historically enjoys some of the most competitive rates in the country, 2024 marked a turning point, pushing many consumers to re-evaluate their coverage and carriers to reassess their pricing strategies.

Independent agents remain dominant in the Ohio P&C marketplace, writing approximately 64.5% of all policies. Among these, the largest line of business for IAs was private passenger auto—also the largest overall line in Ohio by direct premium written—followed by homeowners’ multi-peril.

Trends from the Past Five Years

Over the past five years, Ohio’s auto insurance market has seen steady evolution driven by economic and technological forces. Premiums have consistently climbed—driven by inflation and increasingly complex vehicle technology—averaging 9.5% growth annually in personal auto, with a five-year average of 7.4%. Despite these increases, Ohio carriers have generally maintained stronger underwriting performance than the national average, with loss ratios holding in the mid-60% range versus nearly 70% nationwide.

Independent agents have slightly grown their share of personal lines, continuing to outperform direct writers in areas like retention and customer service. Meanwhile, mergers and acquisitions—such as Liberty Mutual’s purchase of State Auto—have led to further market consolidation. At the same time, more insurers have adopted telematics, using real-time driving data to refine pricing and risk assessment. Together, these trends have shaped Ohio into a resilient, adaptive market, though of course still subject to broader economic pressures.

A Look at Ohio’s Top Auto Insurance Carriers in 2025

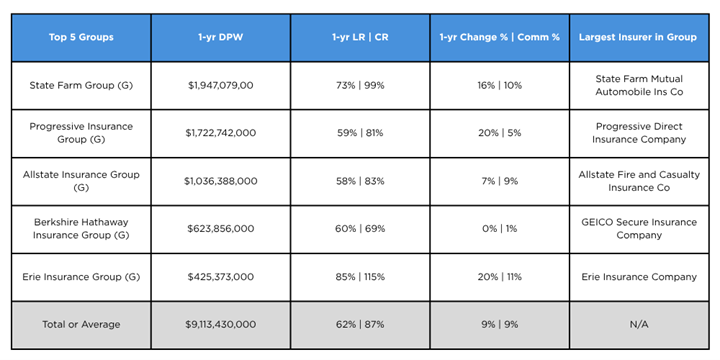

Ohio’s private passenger auto insurance market is led by a combination of national giants and strong regional carriers. Below is a closer look at the five largest personal auto insurers in Ohio, based on direct written premium, underwriting performance, and average agent compensation.

State Farm Group

State Farm is Ohio’s top all private passenger auto insurer, writing approximately $1.95 billion in direct premiums and capturing 21% of the market. With a loss ratio of 73% and a combined ratio of 99%, State Farm is hovering just below the break-even point for underwriting profitability. Agents placing business with State Farm can expect an average commission rate of 10%, which aligns with the standard range for personal lines.

Progressive Insurance Group

Progressive closely follows State Farm, holding 19% market share and writing $1.72 billion in premiums. Known for its strong digital presence and emphasis on usage-based insurance programs, Progressive’s loss ratio of 59% and combined ratio of 81% indicate solid underwriting results and operational efficiency. Progressive offers agents an average commission of 5%, reflecting its heavy investment in direct-to-consumer distribution and lower reliance on traditional agency channels.

Allstate Insurance Group

Allstate maintains an 11% share of Ohio’s PPA market, with $1.04 billion in direct written premiums. Its loss ratio of 58% and combined ratio of 83% are among the best in this group. Agents placing auto business with Allstate can expect an average commission rate of 10%. The company’s hybrid model of captive agents and digital tools helps it compete across multiple customer segments.

Berkshire Hathaway Insurance Group

Berkshire Hathaway holds a 6.8% market share in private passenger auto, yielding a 60% loss ratio and combined ratio of 69%. With no premium growth from 2023-2024, the average commission percentage for Berkshire lies at 1%.

Erie Insurance Group

Erie rounded out the top five with the highest one-year loss ratio and combined ratio at 85% and 115% respectively. Representing less than 5% of the market share, Erie’s mixed bag in performance has continued into 2025 amidst rising claims and added costs in cybersecurity breaches.

Together, these five carriers account for over $9 billion in personal auto premiums in Ohio as State Farm and Progressive dominate by volume. For agents navigating a challenging market shaped by inflation, rising claim costs, and evolving distribution models, understanding each carrier’s underwriting performance and compensation structure is essential. Matching clients with the right carrier—and aligning with those that support strong agency partnerships—can make all the difference in building long-term business success.

The Road Ahead: 2025 and Beyond

As we look toward 2025, several factors are expected to shape the performance of Ohio’s personal auto insurance market—some familiar, others emerging. Inflation and rising claim costs remain a primary concern. Vehicles are becoming more complex, especially with the increased use of advanced driver-assistance systems (ADAS). While these features can reduce accident frequency, they’re costly to repair, which continues to push claim severity upward.

Theft trends will also continue to play a role in rising insurance claims. Although Ohio saw a major drop in catalytic converter thefts—falling from 420 in 2023 to just 77 in 2024—the state still ranks in the top ten nationally for these claims. Meanwhile, auto theft overall is on the rise. These issues are driving higher loss costs and putting upward pressure on rates.

Technology continues to reshape the landscape. Usage-based insurance (UBI) and telematics programs are becoming more common, allowing insurers to offer better pricing to safer drivers while gaining more accurate insights into risk. Adoption of these programs is expected to grow by 20–30% over the next few years.

From a regulatory standpoint, Ohio has remained relatively stable, but it’s important to keep an eye on developments in neighboring states. Increases to minimum liability limits or other regulatory changes elsewhere could influence carrier strategy in Ohio, even without direct legislation. Severe weather is another factor to watch. While Ohio doesn’t face the same exposure as coastal states, events like tornadoes, hailstorms, and high winds are becoming more frequent—and with that comes more unpredictability in underwriting and pricing models.

Finally, electric vehicles (EVs) and autonomous driving technology are advancing quickly, presenting new underwriting challenges and potentially changing the way insurers approach liability and repair cost structures. In fact, it seems autonomous vehicles are becoming increasingly popular by the minute. According to Goldman Sachs analyst Mark Delany, “Autonomy has the potential to significantly reduce accident frequency longer-term and reshape the underlying claim cost distribution and legal liability for accidents.” Analysts project that the autonomous vehicle industry will experience rapid growth, reaching an estimated $7 billion by 2030. Within that, the U.S. market for autonomous virtual drivers specifically for Class 8 trucks could be worth about $5 billion. This week, Tesla Inc. is expected to unveil its long-anticipated robotaxi service in Austin, Texas—a city quickly emerging as a hub for the autonomous taxi sector. Other major players like Alphabet Inc.’s Waymo are already operating in the area.

All in all, Ohio’s auto insurance market is heading into a new chapter—one shaped by innovation, evolving risks, and ongoing economic pressures. For agents and carriers alike, staying proactive and adaptable will be key.

Agent Tips: Talking with Clients About Auto Insurance

With rising rates and complex coverage decisions, agents play a key role in keeping clients informed and confident. Here are a few ways to start the conversation:

- “Here’s why rates are increasing—and what we can do about it.” Walk clients through the real-world factors behind premium hikes.

- “Let’s look at usage-based discounts.” Many carriers offer telematics programs that reward safe driving.

- “Are you protected from today’s repair costs?” Review deductibles and limits to ensure coverage keeps pace with vehicle technology and value.

Want to dive deeper? Here are some quick explanations for common client questions:

- Repair costs are up: Today’s cars are packed with tech—making even minor damage expensive.

- Parts & labor shortages: Supply chain delays and technician shortages mean pricier, slower repairs.

- Theft is on the rise: Ohio continues to see increased vehicle and catalytic converter thefts.

- Medical costs keep climbing: Injury claims are more expensive as healthcare costs rise.

- Weather events are more frequent: Storm damage isn’t just a home issue—it hits vehicles, too.

- Legal costs are growing: Higher settlements and legal fees are driving up liability rates.

Keeping conversations clear and proactive builds trust—and helps clients make confident, informed choices.

About the Author:

A millennial in a risky business affectionally referred to as The Beyoncé of Insurance – it’s no secret that Ashley Fitzsimmons is an insurance nerd with a passion for this industry. She’s been in your shoes. After nearly a decade as the fourth generation in an independent agency near Scranton, PA, she switched gears from educating her clients to educating agents as the Director of Professional Development at OIA.

Her love for her clients helped secure the 2018 National CSR of the Year award. She was even able to turn her misadventures in online dating into writing policies. In traveling to different events and meeting hundreds of agents, she realized she can make an even bigger impact by helping independent agents thrive all over the country. Connect with her. Use her as a resource. Or just have a martini with her – whatever it is, she’s here to help!

Sources:

This report summarizes 2024 data available from the A.M. Best Company report released June 1, 2025 and the Ohio Marketplace report prepared by Real Insurance Solutions Consulting, LLC. Principal: Paul A. Buse – Website: www.realinsurancesc.com – Contact Information: 301-842-7472