In 2024, the umbrella and excess liability insurance market experienced significant shifts, largely driven by rising litigation costs, more selective underwriting, and the emergence of new types of risk.

Premiums rose by low double digits, reflecting an increase in claims severity and a more cautious stance from insurers. This was especially evident in high-risk classes, where building a $5 million umbrella layer often required participation from multiple carriers rather than the traditional single-carrier approach.

A defining theme of the year was the tightening of capacity. Many insurers scaled back their lead umbrella limits from $5 million to between $2 and $3 million. This change was likely prompted by the growing number of “nuclear verdicts,” when jury awards exceed $10 million, which have become more frequent in recent years. The number of nuclear verdicts rose to 135 in 2024, a 52% increase over 2023. While Ohio doesn’t rank among the top ten states for nuclear verdicts, the total value of 2024 cases reached $31.3 billion—a 116% increase from the previous year. That’s more than enough to prompt carriers to reassess their risk appetite and pricing strategies.

Underwriting also grew more selective. Accounts involving youthful drivers, rental properties, or small businesses with public-facing operations received increased scrutiny. Attachment points, the level where umbrella coverage begins, became stricter for clients with past losses or more complex liability profiles.

Despite the challenges, demand for umbrella insurance remained strong. Both individuals and businesses sought higher liability limits to protect their assets in an increasingly litigious climate. Independent insurance agents, who control 64.5% of Ohio’s P&C marketplace, played a critical role in educating clients on the value of umbrella coverage, often introducing these policies during auto and home renewals or major life events.

Overall, 2024 marked a year of recalibration in the umbrella insurance market, as insurers worked to strike a balance between risk, capacity, and client needs within a complex legal and economic environment.

Key Market Leaders

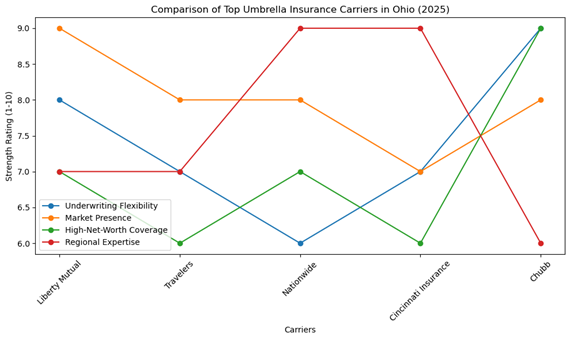

Ohio’s umbrella insurance market is shaped by a mix of national and regional carriers. Although the Ohio Department of Insurance does not publish umbrella-specific rankings, broader casualty and liability data reveal several key players: Liberty Mutual, Travelers, Nationwide, Cincinnati Insurance, and Chubb.

Liberty Mutual and Travelers are strong across both personal and commercial lines, offering scalable umbrella products with flexible underwriting. Nationwide leverages its national presence to offer competitive umbrella solutions, particularly when bundled with home and auto coverage. Cincinnati Insurance stands out for its conservative approach and strong relationships with independent agents. Chubb remains a preferred option for high-net-worth clients, offering broad, global coverage with high limits.

These carriers not only lead in premium volume but also influence the overall market. Their underwriting standards, pricing models, and risk appetite serve as benchmarks for others in the region.

What’s Driving Growth

The umbrella insurance market is being propelled by several important factors. As home values, wages, and investment portfolios increase, so does the demand for higher liability limits to safeguard personal and business wealth. At the same time, the growing risk of high-dollar litigation has made umbrella coverage more valuable than ever.

Technology is also playing a role. Improvements in digital underwriting and online distribution platforms are making it easier for agents and consumers to quote, bind, and manage umbrella policies. The result is a more accessible and efficient insurance experience for all parties involved.

Additionally, the cultural and legal climate continues to influence growth. The rise of litigation funding and more plaintiff-friendly jury behavior are increasing both the likelihood and cost of claims. These developments reinforce the need for broader coverage and make umbrella insurance a core part of any comprehensive risk management strategy.

Outlook for 2025 and Beyond

As we look ahead, the umbrella insurance market is expected to continue expanding, driven by heightened awareness of liability risk, rising asset values, and increasingly complex exposures. In Q1 2025, the average premium renewal rate change for Umbrella experienced an increase at 9.26% versus 8.76% in Q4 2024. The quarter began with the highest rate change in January, averaging 9.47%, and reached its lowest rate in February, averaging 9.03%. This upward trend underscores growing demand for protection beyond standard policy limits, as both individuals and businesses reassess their coverage needs.

Several factors will shape market performance in the coming years. The availability and affordability of umbrella coverage will depend heavily on insurers’ capacity strategies. Their willingness to offer higher limits and manage layered policies will directly affect pricing and accessibility in the years to come.

The shift in carrier capacity is largely a reaction to the rise in nuclear verdicts. Between 2022 and 2023, jury awards over $10 million rose by 27%, pushing loss costs higher and prompting a reassessment of risk tolerance among insurers. The increase in large settlements has led to a 15-year high in overall verdict severity, with expectations that the trend will likely continue through the rest of this year.

Regulatory changes could reshape underwriting strategies, particularly if new rules mandate the disclosure of litigation funding or place caps on damages. Social inflation and the growth of third-party litigation funding have further complicated the picture, increasing both the frequency and severity of claims.

Economic conditions—such as inflation, wage growth, and property appreciation—will also influence both claims severity and coverage demand. Emerging exposures like cyber threats, online defamation, and liabilities related to the gig economy will continue to challenge carriers to rethink how they evaluate both personal and commercial risk. As these risks expand, carriers will need to offer more nuanced umbrella products.

Agents Leading with Confidence

In an era of rising legal risks and financial complexity, umbrella insurance has become an essential part of financial planning. For personal clients, it offers an affordable way to safeguard assets beyond what home and auto policies cover. For businesses, it serves as critical protection against catastrophic losses that could threaten operations or reputations.

Agents can position the umbrella discussion with clients effectively by:

- Using relatable “what-if” scenarios – such as a teenage driver causing a serious accident or a guest slipping and falling on a client’s property.

- Highlighting affordability – for example, a $1 million personal umbrella policy

- Framing it as lifestyle protection – not just a fear-based product, but a way to preserve financial stability and peace of mind.

- Timing the conversation strategically – such as during home or auto renewals, or major life events like marriage, a new home, or business expansion.

- Clarifying the difference between umbrella and excess liability – helping clients understand how each fits into a layered protection strategy.

By proactively guiding these conversations, agents can build stronger relationships, demonstrate expertise, and deliver real value—while helping clients stay protected in an increasingly unpredictable world.

About the Author

Jeannine Giesler, CISR, CPIA, and past President of the OIA Board of Directors, Foundation for the Advancement of Insurance Professionals, currently serves as Resource Center Advisor for the OIA. The purpose of the Resource Center is to contribute to building a comprehensive library of resource materials for our members. We pride ourselves on being the one-stop shop for all OIA members and work to solve every problem or situation you may come across.

Jeannine Giesler, CISR, CPIA, and past President of the OIA Board of Directors, Foundation for the Advancement of Insurance Professionals, currently serves as Resource Center Advisor for the OIA. The purpose of the Resource Center is to contribute to building a comprehensive library of resource materials for our members. We pride ourselves on being the one-stop shop for all OIA members and work to solve every problem or situation you may come across.

Sources:

2025 Ohio Annual P&C Marketplace Summary: Ohio Direct Premium Written: By Line of Business

Real Insurance Solutions Consulting, LLC. Principal: Paul A. Buse – Website: www.realinsurancesc.com – Contact Information: 301-842-7472

IVANS Released April 22, 2025

Average premium renewal rates for all major commercial lines of business except Workers’ Compensation remain up year over year; nearly all rates down quarter over quarter

https://www.ivans.com/news/press-releases/2025/ivans-index-q1-2025-results-released/

Risk Placement Services

2025 Q2 Umbrella and Excess Market Update https://www.rpsins.com/learn/2025/apr/2025-q2-umbrella-and-excess-market-update/

2025 US Casualty Market Outlook

CORPORATE Verdicts Go THERMONUCLEAR: “Corporate Verdicts Go Thermonuclear: 2024 Edition,” Marathon Strategies, 2024. PDF file.

2024 Q2 Umbrella and Excess Services https://www.rpsins.com/learn/2024/may/2024-q2-umbrella-and-excess-market-update/

GenRe: Upward Pressure on Loss Ratio, Commercial Umbrella, Personal Umbrella April 05, 2023, Maria Slowinski, Karen Tuomi Region: North America

Insurance Journal

Six Things to Know About Umbrella Insurance By Allen Laman | June 16, 2025

https://www.insurancejournal.com/news/national/2025/05/22/824792.htm#

https://www.insurancejournal.com/magazines/mag-features/2025/06/16/827433.htm

2025 US Casualty Market Outlook https://www.rpsins.com/learn/2025/jan/2025-us-casualty-market-outlook/

Umbrella Insurance Market Overview – Market Research Future www.marketresearchfuture.com

Umbrella Insurance2025 -2033 Trends: Unveiling Growth Opportunities www.datainsightsmarket.com