This is this first article in a two-part series on the workplace changes, impacts and solutions for independent agents as a result of COVID.

The impacts of COVID are plentiful and rapidly swelled into all aspects of our lives. It is the result of the global pandemic that many businesses hit the accelerator on remote work, whether it was for a couple of months or the past year. Pre-COVID, remote work was the exception to the rule in the insurance industry. While agencies and companies were open to it, we were predominantly working in an office environment five days a week.

Now remote work has become the new norm and we must explore the ramifications of these changes. A compelling question is whether we expect these changes that came out of a need to combat COVID become permanent and make it even more difficult for small independent agencies to recruit and retain talent?

Has COVID further disadvantaged small agencies?

Competing for top-tier talent has been something small independent agencies have struggled with compared to their larger peers and insurance companies. Yet they have always had an important intangible benefit to leverage – time.

Time is often touted as our most valuable asset. For small independent agencies, time equaled flexibility and could typically be positioned with prospective talent as a competitive benefit in comparison to larger, rigid, and less flexible employers. Flexibility with time, work location, and more relaxed handbook policies seemed much more manageable for a family-friendly office environment of 7 employees versus 70, 700 or 7,000 associates in a large company.

Positioning these intangible benefits as an enhancement to the prospective employee’s quality of life could prove to be a strong recruitment and retention tool. While values, culture, flexibility, and other intangibles are great ways for small agencies to differentiate themselves, the measurable and tangible benefits that every current and prospective employee consider are compensation and benefits.

These are two categories that small agencies have typically lagged, many for obvious reasons, including less revenue, resources, and size.

Comparison of Small and Large Agencies in Compensation and Benefits

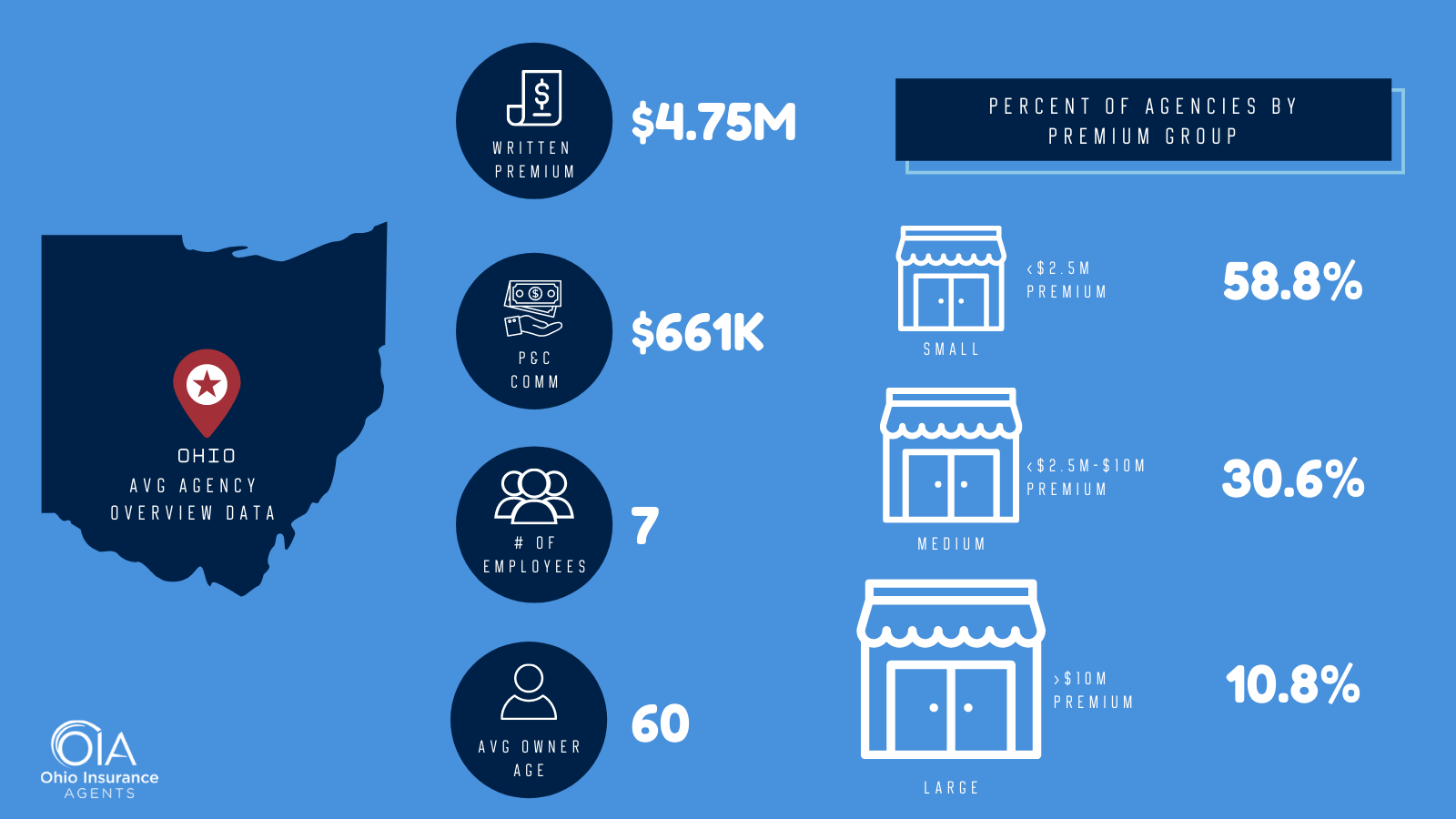

According to IntellAgents data, the average agency in Ohio generated $4.75M in Written Premium, $661K in P&C commissions, has 7 employees and owners with the average age of 60. While those are the averages, we know that 58.8% of agencies are less than $2.5M in Annual Written Premium (AWP), 30.6% are between $2.5M – $10M in AWP and only 10.8% of agencies are over $10M in AWP.

When we compare the two tangibles in employment, we intuitively know there are wide gaps between small and large agencies on both compensation and benefits. The data confirms our intuitions.

Based on compensation data, small agencies (less than $2.5M in WP) pay an average of $45K per employee while large agencies (more than $10M in WP) pay an average of $72K.

The gap widens as we look at employee benefits. Based on this data, only 23% of small agencies provide health insurance, 30% provide retirement benefits and 8% provide Health Savings Accounts (HSA).

To the contrary, large agencies provide these benefits at much higher rates: 95% provide health insurance, 76% provide retirement benefits, and 69% provided HSAs.

According to the Ohio Insurance Institute (OII) 2020 Insurance in Ohio Report, the average annual salary for a P&C insurer was $96K. While there is a $24K gap between average carrier compensation and the $72K large agencies pay, with benefits and upward mobility opportunities, large agencies can compete for insurance talent with companies and vendors.

This is not the case for small agencies. The gap for small agencies on compensation alone is $51K. So small agencies have to overcome the lower compensation, benefits, and lack of upward mobility with the tangibles of ownership opportunities and intangibles of family environment and flexibility for employees.

COVID workplace changes

However, based on what has happened with COVID it now appears the playing field is leveling with more and more large companies offering remote work and flexibility options that are very comparable to what you would find in a small employer environment.

Pre-COVID, small agencies are where you would seek out opportunities with great flexibility for their employees. For instance, anecdotally they provided greater flexibility for working parents to tend to sick kids from home, attend their children’s activities, and other daily life hustles. With remote work becoming the new norm that flexibility advantage is muted.

More large companies are moving to permanent remote work options and greater flexibility for their employees to work anywhere and at any time. Pre-COVID, the “no work rules” environment was something you read about in an NYT Bestseller and limited to a few select Silicon Valley tech startups like Netflix. Now it appears to be becoming the norm…even in the insurance industry.

Pre-COVID, remote work and flexibility discussions were driven by a few brave employees. Now it is the expectation of all working professionals. It is no longer a competitive advantage for any size employer, rather it is now the equivalent of compensating someone for their work.

We all expect that at some point the pendulum will swing back and (hopefully) employees will want to return to an office environment but that appears to be years off in the distance. In the meantime, small agencies need to be crafty and develop options to compete for top-tier talent.

So, what is a small agency to do? The tangibles like ownership opportunities and intangibles like values and culture become even more important in this environment.

Stay tuned to our next publication in this series where we will explore ideas, options, and solutions. In the meantime, stay connected to the OIA through our social channels and website to hear more data and stats on this topic this week.