By Jeff Smith, JD, CIC, CAE

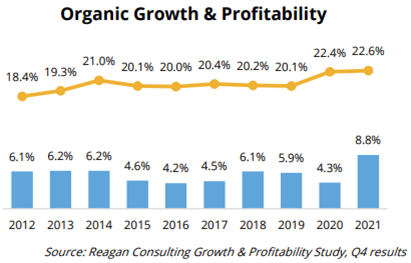

Based on recent studies published on the health of the independent agency system, the gap between high and low performing insurance agencies is significant. According to the 2022 Big I-Reagan Best Practices Study, the top quartile of Best Practices agencies grew by over 22% and the average best practices agencies grew well over 8%. As the study put it, “2021 was the best year in memory for insurance agents and brokers, with record organic growth of 8.8%. While premium increases and new business activity continued to play a large role, the U.S. economic rebound, which posted the highest GDP growth rate since 1984, was likely the primary driver of the dramatic increase in year-over-year organic growth rates.”

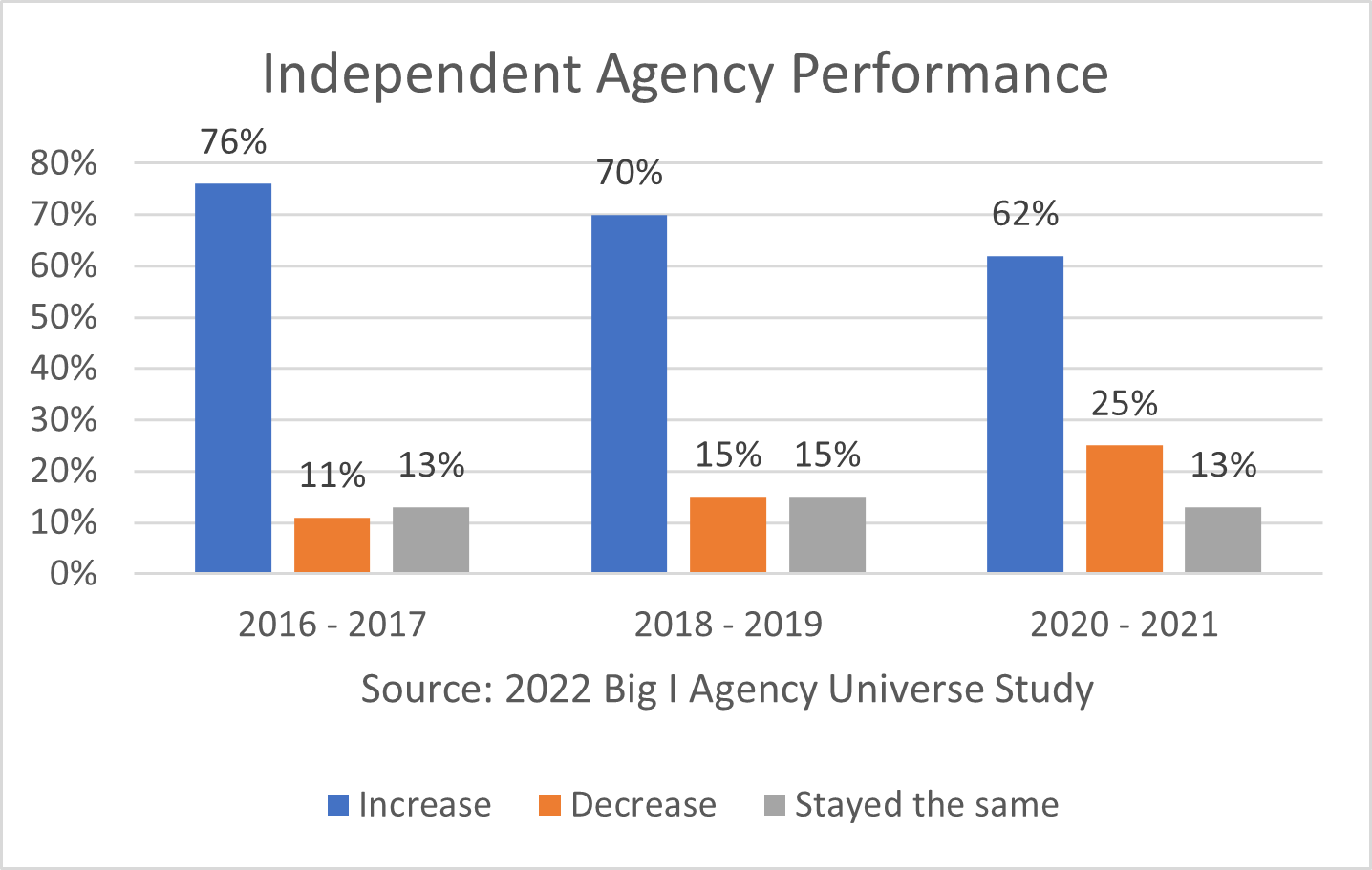

Contrast that growth with the results from the 2022 Big I National Agency Universe Study, which showed that 62% of agencies saw revenue increases between 2020 and 2021, down from 70% in 2018 and 2019 and 76% in 2016 and 2017. More alarming is that approximately 25% of agencies reported a decrease in revenue, up 10% from 2018-2019.

This shows a massive gap in performance between the highest and lowest performing agencies at a time when market share for independent insurance agencies is steadily increasing. The rolling 12-month growth for independent insurance agencies is 10%, far outpacing the 5% growth of both the direct and captive channels.

Let’s review some of what may causing this wide gap and the effect it will have on an agency’s valuation. First, what may be causing it:

- Independent insurance agencies that are reporting high organic growth are investing heavily in producers and their staff. These agencies tend to have lower owner and producer age ranges, meaning better balance to their generational health. Whereas low performing agencies are stagnant, not investing in talent and skew in the higher age range for owners and producers.

- High performing agencies have a greater focus on commercial accounts than personal lines. Best Practices agencies are growing three-fold in the commercial lines than personal lines.

- High performing agencies are investing in technological solutions, scaling to create greater efficiencies in their operations and removing previous barriers to their geographic reach. Declining agencies continue to operate without many of the modern-day technologies to create scale, improve efficiencies and foster growth.

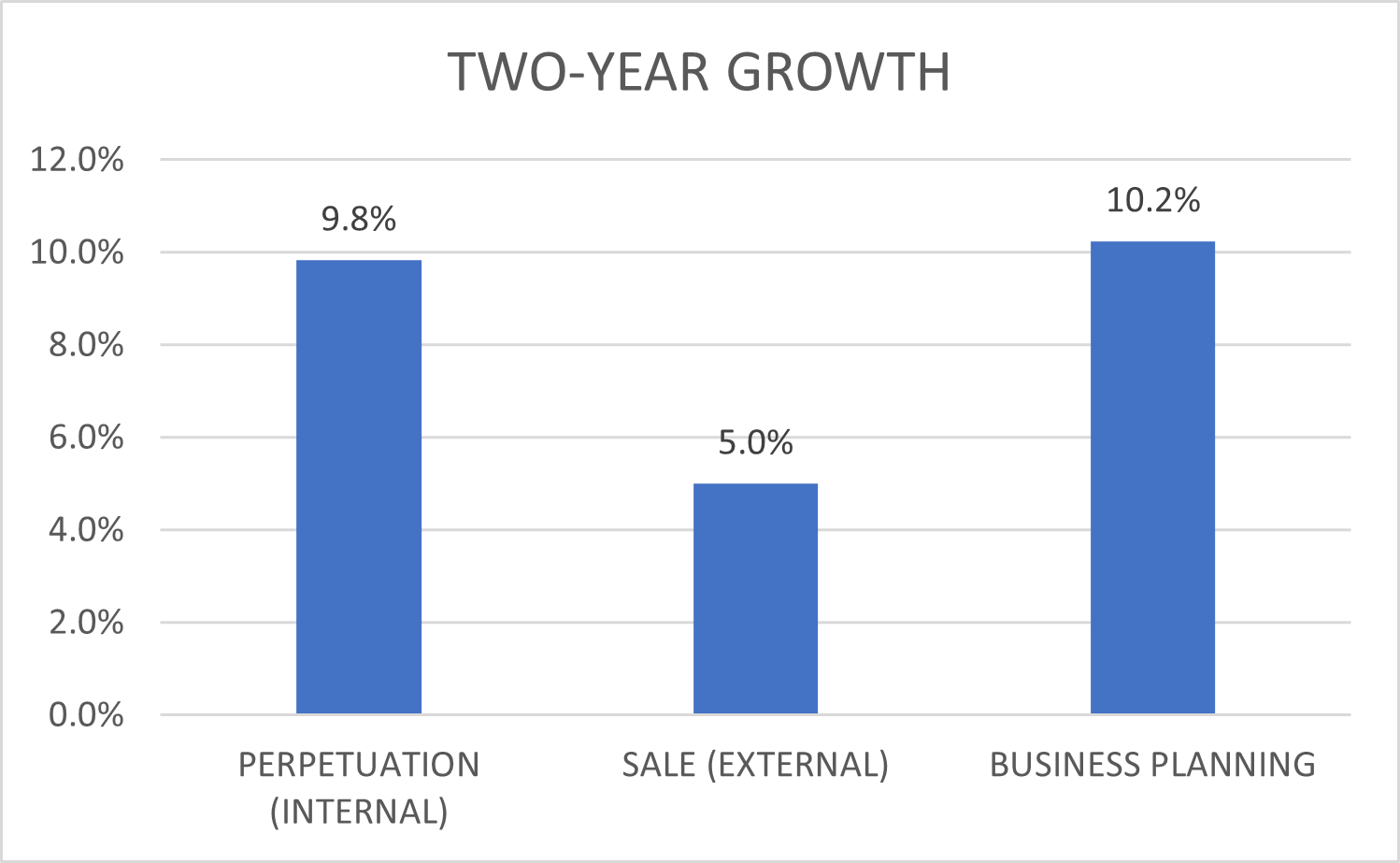

Finally, let’s analyze what impact will this have on an agency’s valuation. According to IA Valuations data, growing agencies that are focused on business planning and have two-year growth trends of 10% can have an EBITDA valuation multiplier of .5 to 2 basis points higher than those that are stagnant, declining and plan to sell externally without internal staff.

In practical terms, what does this mean for you or the average agency owner. Take two $600K annual revenue agencies. The first is the lower performing agency we described earlier and has an EBITDA valuation multiplier of 6X and EBIDTDA profitability margin of 25%. The second is the growing agency with an EBIDTDA valuation multiplier of 9X and a profitability margin of 25%. The difference in value between these two agencies is $450K.

Simply put, the difference in agency valuation between a growing agency and a declining one is hundreds of thousands of dollars for the owners in a sale. It is three years of early retirement, it is a second home for your family, and fulfilling your dreams post agency ownership. It pays to business plan, invest in talent and grow your agency.

To discuss this and more topics on agency valuations, transition planning and your future as an agency owner, please contact Jeff Smith at Jeff@iavaluations.com.

About IA Valuations – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2022 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.