We are experiencing the greatest wealth transfer in the history of the independent agency (IA) system and traditional retail independent insurance agencies (privately held) are getting crushed in the merger and acquisition (M&A) game.

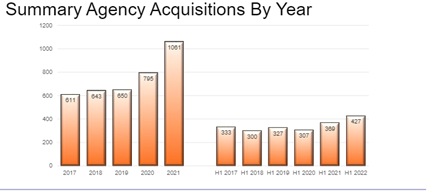

According to Optis Partners, the IA system experienced a record 1,061 M&A transactions of independent agencies and brokers in 2021. There was a record 427 M&A transactions reported in H1 of 2022.

This represents billions of dollars in revenue transfer from one agency owner to another. Much of this is driven by the highly anticipated retirements of the Baby Boomer generation and it is not finished yet as 33% of independent agency owners are still in the Baby Boomer generation. Which means billions of dollars in revenue is due to change hands over the next 5 years.

Ordinally this would not be concerning for the IA system, however given the lack of viable internal perpetuation options, record high independent agency valuations and massive infusion of private equity (PE) dollars into the IA system and we are facing a major realignment of the IA business model.

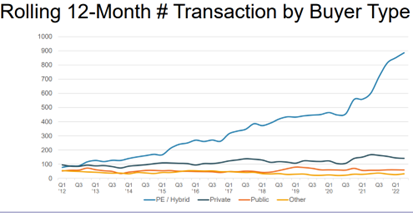

M&A is a natural part of every industry’s evolution and certainly not new to the IA system. However, PE firms are dominating the M&A landscape which is quickly leading to the diminishing of the agent entrepreneur business owner. Optis Partners reports on the type of buyer and this graph shows that PE buyers are now responsible for 90% of the M&A activity in the IA system. If this continues, agent entrepreneur business owners will be extinct and the only thing they will own are shares in the PE firm that purchased their agency.

While traditional retail independent agencies are currently getting crushed by PE firms in the M&A game, it does not have to be that way.

In addition to the valuation services we provide at IA Valuations, we also advise agency owners on buying and selling agencies through Agency Link. Most of our client engagements start with agency owners who are ready to sell their agency and want to explore the marketplace to better understand their options and the process for consummating what is likely the single largest financial transaction of their lifetime.

In most instances, we find the seller would prefer to sell to their local, friendly retail agency competitor however in most instances they are completely ill equipped to compete with the PE firms.

In our experience, traditional retail independent agencies lack the sophistication, preparedness and financial support to overcome the current tidal wave overtaking the IA system.

Most agency owners that have espoused a growth by acquisition strategy do not understand the game that is being played and are severely out of date with the tactics in today’s M&A marketplace. Many agency owners are still hanging on to the long-held experiences of an agency owner coming directly to them to sell their agency and having the owner finance the agency purchase over a period of time.

The game has changed! If you take nothing else from this article, please know the game has changed.

First, M&A advisors are commonplace in all transactions now. While M&A advisors are not a new phenomenon for large agency transactions, they are fairly new to small to mid-sized agencies. It is now an option for every transaction and all parties should expect to be represented and put through a process.

We strongly believe that unless an agency owner is perpetuating internally, no owner should sell their agency without engaging an advisor in the sale transaction. No one would sell their home or any other meaningful financial asset without testing the market. One of the fundamental principles of capitalism is to create a marketplace and options to transact business. Competition always results in a better outcome for all of the parties involved.

Second, PE firms have headhunters that are constantly scouting for new agency acquisition opportunities. You should expect that they are talking to that longtime prospect that you have had your eye on for years.

Third, sellers are not typically financing external transactions over 5 – 10 years. Most want a significant lumpsum up front. PE firms are well equipped to do this at top dollar. Traditional retail agencies can overcome this by conducting deep due diligence on the financials and book of business and working with an IA centric lender.

Fourth, sellers are not selling externally at a discount. You wouldn’t do it so do not expect someone to do it for you. It is a seller’s market so be prepared to be part of a bidding process and pay the going rate for an agency.

Traditional retail independent agencies can overcome the recent trend of PE acquisitions in this space. However, it is going to require agency owners to get way more serious and better prepared to overcome some of the competitive advantages PE firms have in the current marketplace.

If you are serious about acquisition on either side, please prepare yourself and play in today’s game.

If you read this article you are likely thinking about buying or selling an agency. Please take these steps, start lining up your advisors and connect with them so you are prepared when the opportunity arises.

In every transaction, you should have an M&A advisor, legal counsel, tax advisor and financial advisor. For transactions with lending, talk to an independent agency focused lender, like Insurbanc, Westfield Bank or Live Oak. They will give you great insights on the process, they speak your language and process IA transactions every single day.

We need more traditional retail independent agency buyers otherwise the billions of dollars of IA revenue will be concentrated in a few PE firms and publicly traded brokers. We invite you to engage with the IA Valuations team to get started devising your strategy on buying or selling your agency. Please reach out to me at jeff@iavaluations.com for more information and look for our educational webinars on these topics.

About IA Valuations – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

Copyright ©2022 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please reach out to contact@iavaluations.com to discuss your personal situation.