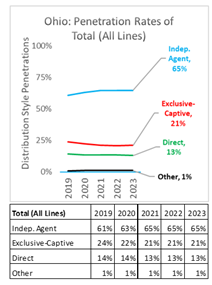

The final numbers are in for the 2023 Ohio P&C marketplace report and it shows Ohio independent insurance agents continue to write the majority of the insurance (65%) in the state. The overall market share percentages remained the same YOY, the only changes were in Personal Lines (PL) where IAs grew 1% market share from the direct writers but lost 1% of Farm-Ag policies to direct writers.

Ohio IAs continue to outpace the national average by 2% in terms of overall P&C market share (65% to 63%). Below are some of the highlights.

Premiums Overall

In 2023, Ohio P&C premiums reached $23.4 billion, ranking Ohio 11 of 51 in total premiums in the United States. That is 2.5% out of $952 Billion in premiums nationwide. On a relative comparative basis, per capita premiums rank Ohio 51 of 51 for all P&C premiums combined, 48 of 51 for Personal Lines, 51 of 51 for Commercial Lines, and 23 of 51 for Agricultural Lines.

Lines of Business

In Ohio, the 65% market share for IAs represents over $15B of the $23.4B P&C marketplace.

The largest Line of Business for independent agents was All Private Passenger Auto at 22% (as determined by direct written premium). The second largest Line of Business in Ohio was Homeowners Multi-Peril at 16%, and the third was Commercial Multi-Peril at 11%. Commercial Auto and Other Liability (Occurrence) were both close 4th at 10%.

For comparison, in the United States, the Top 3 Lines of Business are; All Private Passenger Auto, Homeowners Multi-Peril, and Other Liability (Occurrence).

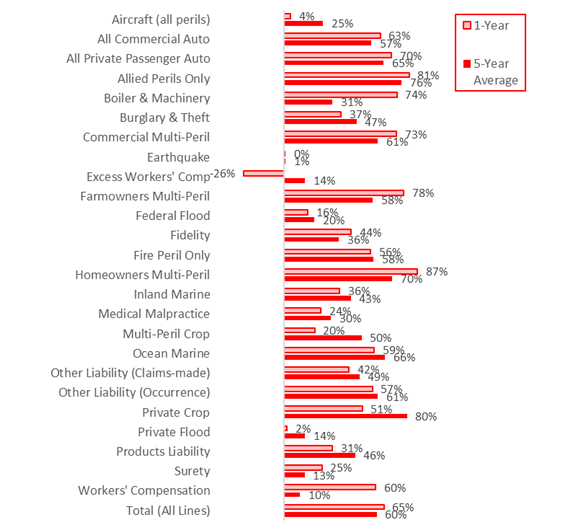

Loss Ratios

Ohio’s average loss ratio across all P&C Lines of Business was 65.0%, with the highest loss ratios experienced in Homeowners Multi-Peril (86.7%), Allied Perils Only (81.4%), and Farmowners Multi-Peril (77.9%). Comparatively, the United States average loss ratio was 66.0%, with the highest loss ratio in Hawaii (140.5%), and the lowest in the District of Columbia (43.4%). In the United States, the Lines of Business with the highest loss ratios are Multi-Peril Crop (102.2%), Private Crop (98.8%), and Farmowners Multi-Peril (79.0%).

Ohio is traditionally a stable and predictable insurance state from a loss standpoint. With a record number of tornados and convective storms over the past 18 months, Ohio’s status as a profitable insurance state is experiencing some severe short term turbulence. In looking at the 3 largest areas of an IAs business (Home, Auto, and Commercial Multi-line), we see two double-digit increases and a slight decrease in YOY loss ratios.

months, Ohio’s status as a profitable insurance state is experiencing some severe short term turbulence. In looking at the 3 largest areas of an IAs business (Home, Auto, and Commercial Multi-line), we see two double-digit increases and a slight decrease in YOY loss ratios.

The largest YOY increases in loss ratios were in the Homeowners Multi-Peril which experienced a 12% increase. All Private Passenger Auto experienced a 2% YOY decrease and Commercial Multi-Peril saw an 11% increase YOY.

Premium Change Rates

Premiums grew 10.4% in Ohio from 2022 to 2023 for all P&C Lines of Business combined, placing it 20 of 51 in the United States and District of Columbia. The fastest growing Lines of Business in Ohio are Fire Peril Only (24.0%), Earthquake (16.0%), and Aircraft (all perils) (14.8%). By comparison, the United States grew by 10.4%, with the fastest-growing state being Florida (16.1%), and the slowest being the District of Columbia (3.4%). The United States fastest growing Lines of Business are Fire Peril Only (28.9%), Allied Perils Only (24.5%), and Earthquake (16.5%).

Independent Agent Penetration of Marketplace

Independent Agents control 64.7% of the Ohio P&C marketplace. This compares to the United States average of 62.2%, with the highest penetration in Massachusetts (79.6%), and the lowest in Alabama (51.7%). In Ohio, the top penetration rates by Lines of Business for Independent Agents are International (100.0%), Private Crop (99.9%), and Multi-Peril Crop (99.1%). In the United States, top penetration rates by Lines of Business for Independent Agents are International (100.0%), Ocean Marine (96.5%), and Burglary & Theft (96.3%).

Commissions

The average commission rate in Ohio was 11.8% for all P&C Lines of Business combined. By contrast, the average commission rate in the United States was 11.4%. The highest average commission was in the District of Columbia (13.8%) with the lowest in Virginia (10.2%).

In analyzing the 3 largest areas of an IAs business (Home, Auto, and Commercial Multi-line), we see two minor decreases and one remaining the same. Over the 5 year period, every one of the commission rates for the top 3 LOBs decreased slightly.

Private Passenger Auto experienced a .2% increase YOY, and Homeowners Multi-Peril and Commercial Multi-Peril both stayed the same YOY.

Surplus Lines

Surplus Lines utilization is on the rise across all states. In Ohio, the average percentage of premiums going to UNLICENSED insurers (that is, Surplus Lines) was 6.2%. That percentage was 6.1% one year ago and 3.9% five years ago. In the United States, the corresponding figures are 9.3%, 9.0%, and 6.2%, respectively. In Ohio, the top 3 Lines of Business with premiums going to Surplus Lines insurers are Other Liability (Claims-made) (36.1%), Medical Malpractice (35.4%), and Products Liability (31.0%). In the United States, the top 3 Lines of Business with premiums going to Surplus Lines insurers are Earthquake (50.8%), Private Flood (46.2%), and Products Liability (42.1%).

Largest Insurers

State Farm Group (G) was the largest insurer group in Ohio, and it writes 11.6% of all P&C premiums. Cincinnati Insurance Company emerges as the largest pure Independent Agent policy-issuing insurer, State Farm Mutual Automobile Ins Co. as the largest Exclusive-Captive policy-issuing insurer, and Progressive Direct Insurance Company as the largest Direct policy-issuing insurer.

Conclusion

The IA system remains strong across Ohio and the US. While the hard market has been challenging for the insurance industry, it has highlighted the benefits of an independent insurance agent in reviewing coverage and access to multiple carrier options. Specifically, having clients take a second look at their policies has shined a light on problems in coverage areas that create opportunities for IAs.

Specifically, the Homeowners Multi-Peril numbers are showing that IAs are taking over accounts and are adding coverage the captives and direct writers miss like UM/UIM, an umbrella of more than $1 million with UM/UIM added, uninsured e-bikes, jet skis, and other off-road toys.

Every crisis creates an opportunity and the hard market is creating the same for IAs. The IA business model is resilient and the 2023 Ohio P&C market share report just reaffirms that. For a copy of the full report, please reach out to Jeff Smith at Jeff@ohioinsuranceagents.com.