It’s summer in Ohio, so many of us are planning trips to Cedar Point and Kings Island to ride roller coasters. For the last few years, you didn’t need to go to an amusement park to feel like you were riding a roller coaster in the Homeowners market in Ohio. Consistent triple digit loss ratios (average 115% in 2023) combined with double digit premium increases provided Independent Agents (IAs) with more whip lash, belly drops and herky-jerky twists than any manmade roller coaster could provide.

However, after multiple years of a hard market and following the trends of the rest of the insurance marketplace, the Homeowners’ line of business is getting back to a more consistent and stable line of business.

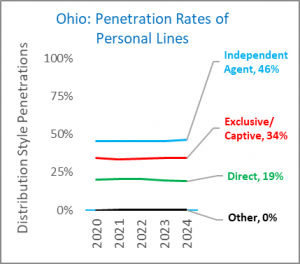

This article explores the performance and key trends shaping the Homeowners insurance market in Ohio. Analyzing the overall performance of IAs in the Personal Lines (PL) market, we see IAs grew 0.8% according to A.M. Best Company. It’s worth noting this was the largest increase in the IA system in the past 5 years. Much of that growth was likely taken from the direct market (dropping 0.7%), indicating consumers are looking for an insurance advisor to provide an explanation and options during these recent times of rate increases.

In the Homeowners’ space, IAs write 58% of the Ohio market. IAs have been dealing with rate increases driven by more frequent convective storm activity and losses, roof claims, and increasing property values. IAs have experienced a significant increase in the number of clients asking them to remarket their account (some as high as 75% of their clients), and new business opportunities for clients have upset their increases from their captive or direct carrier.

Homeowners Markets Turns the Corner in 2024

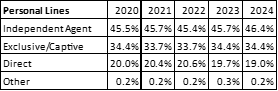

Ohio’s Homeowners insurance market rounded out just under $4.7B in written premium. This makes up 18.5% of the greater $25.4B insurance market in Ohio. The Homeowners market has increased 33% in the past 5 years, holding firm with the rest of the insurance market.

After two straight years of triple-digit loss ratios (2022 – 103% and 2023 – 115%), carriers were able to produce an underwriting profit by decreasing the loss ratio by 23% in 2024 to a combined ratio of 92%.

In the Homeowners line of business (LOB), premiums increased by 14%. Commissions for agents increased slightly to 13.1%, up from 12.9% in 2023.

For the full visual summary of Homeowners in Ohio, download Paul Buse’s data here.

5-year Trends in Homeowners Show Signs of a Return to Stability and Profitability

For three straight years, carriers increased written premiums (33% since 2020), tightened underwriting restrictions, closed off the new business spigot, and non-renewed many homes with aging roofs. The results have proven to be successful.

As the graphs show below, premium increases have been significant over the past 5 years, but IAs have held steady in their control of their market share. In addition, combined loss ratios appear to be on the decline again. 2025 will be a pivotal year to see if this trend continues.

Source: A.M. Best Company

Source: A.M. Best Company

Ohio’s Leading Homeowners Carriers Experience Significant Premium Increases and Improved Results in 2024

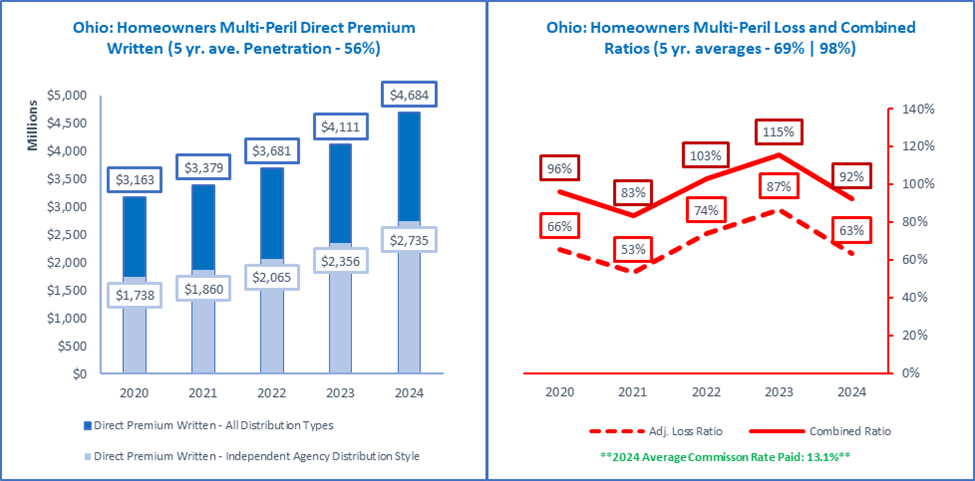

A combination of year-over-year rate increases, strong retention driven by hard market turmoil, and moderate storm activity helped carriers achieve the underwriting profits they were targeting in 2024. The 14% increase in premium across the Ohio Homeowners channel created

The Ohio Homeowners market leader remained at State Farm, controlling approximately 21% of the market in 2024. Their combined loss ratio of 106% was less than stellar, but it did not affect their market position of #1 in Ohio. In addition, Allstate maintained its position as a solid #2 over 10% of the market, a 17% increase in premium YOY, and an impressive combined loss ratio of 79.8%. Particularly impressive for Allstate is its 5-year combined loss ratio in Ohio of 92%.

With the exception of two carriers, eight of the top ten Homeowners carriers experienced written premium increases between 3.4% to 34%. The two carriers that saw a decline in written premium—Liberty Mutual (including Safeco and State Auto) and Nationwide—likely did so after overcorrecting with aggressive rate increases over the past two years.

The top twenty carriers in Ohio write 92% of the state’s written premium. This group remained largely unchanged in 2024, with the exception of Central Insurance, which fell to #23 and dropped out of the top twenty.

The IA carriers that performed exceptionally well in 2024 included Grange, with a 3.4% premium increase combined with an 80.1% loss ratio for the year. If this trend continues in Ohio—Grange’s largest state—it will help improve their five-year nationwide average loss ratio of 106.4%.

Other carriers with notable results include Encova (85.4% combined ratio), Nationwide (79.3%), Cincinnati Insurance (92.3%), Auto-Owners (97.1%), and Progressive (87.9%). Among independent agency carriers with less favorable performance were Erie (108.5%), Westfield (102.2%), and Ohio Mutual (115.5%).

Generally speaking, IA carriers writing Homeowners in Ohio saw combined loss ratios nearly 7% lower than their nationwide results. For example, Grange outperformed its national average by 9% in Ohio, Cincinnati by 1%, Auto-Owners by 15%, Progressive by 8.5%, Westfield by 10%, Western Reserve by 1%, and Encova by 4.5%. Several carriers experienced the opposite effect, where Ohio performed poorer than the national market, but this was the exception to the rule for IA carrier results.

Source: A.M. Best Company

Source: A.M. Best Company

Agents Must Proactively Stay Engaged with their Homeowners Clients

While the Homeowners market in Ohio appears to be softening, this is not a time for IAs to soften their communication and engagement with their Homeowners clients. They must stay proactive in their education and annual reviews. It appears that IAs have weathered the worst of the Homeowners market, but it is unlikely to return to the pre-hard market environment. Carriers are not expected to reduce rates to pre-hard market levels nor remove the roofing coverage restrictions that have been implemented.

Therefore, agents should continue to make sure their clients are well informed of the coverage changes and ways to reduce exposure while keeping their premiums affordable. Proactive communication and education are the best ways to stay on top of client engagement and reduce the risk of your client going somewhere else for their insurance needs.

Much like the final stretch of a roller coaster, this hard market cycle appears to be leveling out after a wild ride, signaling a return to smoother conditions. Another year of underwriting profits and things will start to feel normal again. So far, 2025 has been a relatively quiet year for Ohio homeowners and hopefully that continues through December 31.

About the Author:

Jeffrey S. Smith, JD, CIC, CAE serves as Chief Executive Officer for Ohio Insurance Agents Association (OIA) and IA Valuations. He is responsible for leading the organization’s strategic initiatives and day-to-day operations.

As CEO of IA Valuations, Smith has consulted and reviewed over 200 agency valuations for independent agents across the US. IA Valuations serves independent agencies as a trusted advisor and strategic business partners as they implement strategies to increase their agency value, grow their businesses, and transition their agencies. Smith provides insights into the agency’s operations, risk factors, and legal guidance on how to perpetuate and maximize value in a sale.

Sources:

This report summarizes 2024 data available from the A.M. Best Company report released June 1, 2025 and the Ohio Marketplace report prepared by Real Insurance Solutions Consulting, LLC. Principal: Paul A. Buse – Website: www.realinsurancesc.com – Contact Information: 301-842-7472