Are private equity (PE) backed firms the only buyers in the IA space? Depending on the national trade journal or study you read, that may be what you are led to believe.

However, that’s not what OIA’s data is showing.

The Scoop on Ownership Transitions

The Scoop on Ownership Transitions

Based on our data on mergers and acquisitions/transition of ownership in 2017, Ohio independent agencies have experienced 31 ownership transitions. Of those 31 transitions, 30 (97 percent) were perpetuated internally or bought by other retail agencies.

In 2017, that equates to just over $108 million in premium volume changing ownership hands, and only one of those going to PE firms.

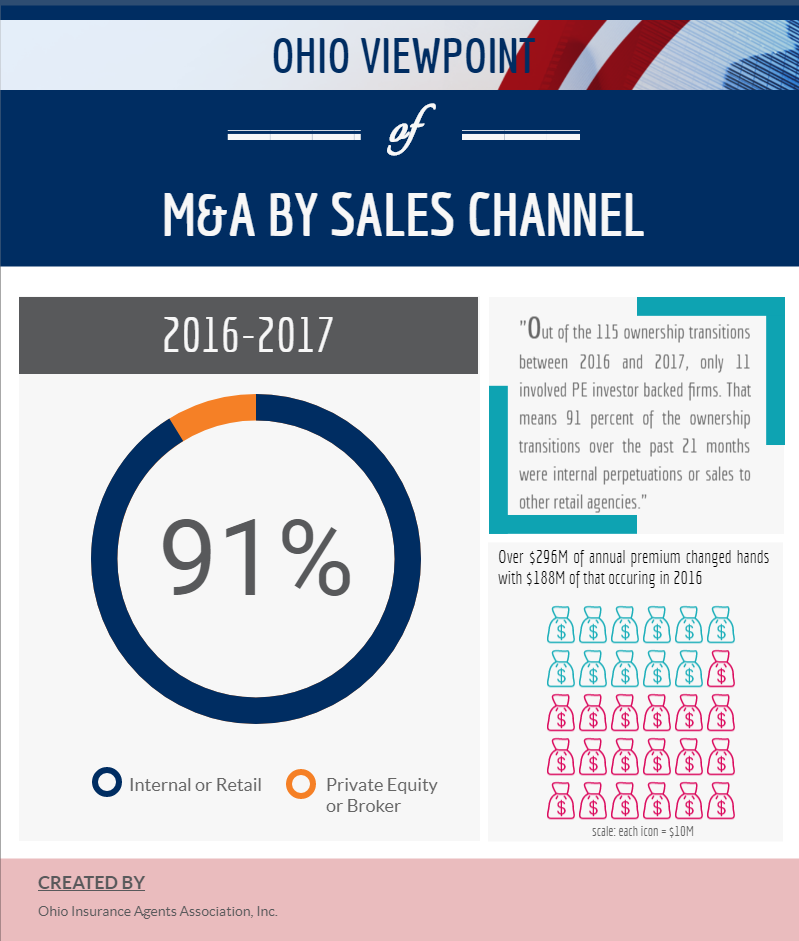

As we look at our data for the 115 ownership transitions covering 2016 and 2017, only 11 involved PE firms. That means 91 percent of the ownership transitions over the past 21 months were internal perpetuations or sales to other retail agencies.

PE Acquisitions On the Rise

This is not to say PE firms are not actively acquiring independent agencies. National data shows a significant increase in PE acquisitions of retail agencies over the past 5 years.

However, we notice that the insurance community tends to hear about the big transactions and forget about the 91 percent representing a much greater volume of ownership transitions.

Take Ohio for example: Most IAs remember and talk about the deals involving larger independent agencies: Brooks Insurance Agency, Hoffman & Associates Insurance Services, Leonard Insurance Services, Kinker-Eveleigh Insurance, Diversified Insurance Services, SeibertKeck and Britton Gallagher.

But we overlook the other 104 transactions that have taken place during a similar timeframe.

While PE firms are on the hunt to acquire agencies, it appears retail agencies are just as hungry to acquire that business. In Ohio, they may have the inside track to being as competitive as PE firms in making those deals happen.

Leveraging Data to Help You

Two final points…

First, OIA is committed to being a data-driven organization. Our goal is to be a market differentiator for IAs. We are better leveraging data to help agents understand their options and make informed decisions about their businesses.

We have long been the trusted and respected resource for IAs with access to volumes of data. But we did not fully utilize this data.

Not anymore.

You will start to see OIA and the products we produce much differently. It will be a market differentiator-level of advice and analysis. We recognize M&A activity is going to persist and likely increase as the baby boomer generation continues to retire.

Therefore, as advocates for IAs, we must step up our game so you make the best business decisions for your clients, agency, family and legacy.

A Trusted Advisor to Independent Agents

On that note, OIA is developing services for IAs to help them in their ownership transition. We expect to have a new strategic business advising service available for agencies in Q1 of 2018.

We will be a trusted advisor to IAs as they consider their succession planning needs, valuation of their agency and other strategic business opportunities.

The details will be out shortly. In the meantime, I hope to see you at IACON17 on October 19-20 in downtown Columbus so you can shift your mindset and transform your future.

*OIA’s data does not cover every ownership transition in the IA space. However, we are not aware of a source that is able to capture every transition. Based on our estimates, our membership comprises around 80 percent of independent agencies in Ohio. Therefore, we believe we are capturing the prevailing trends in our marketplace.